Forex History

In the olden times, goods used to be traded for other goods to close a transaction. It was well known as the barter trade. However, as times passed by, the age of metals was invented, which became the tool of a trade by then, which included silver and gold. This was when the Babylonians thought of exchanging currency for ease of trade in different countries. The exchange of coins to goods became a preferred method of exchange because of portability, durability, uniformity all that made it easy for the traders to close business quickly.

The essence of boarding ships to transport goods to a far country in exchange for another good became a thing of the past.

The currency business took over and eventually became the Forex trading where traders who were interested in an exchange of currency in different states could join. This went on and became a booming business which to date has been part and parcel of a profit-making venture.

Why was Forex History introduced?

The main reason for the introduction of Forex history was to pave the way for reliability and stability in the monetary issues. National interests have also been protected, and market forces have gained a competitive advantage rather than punish the country’s financial responsibility.

As time passed, it was noted that there had been significant impacts that took place as a result of using money which included the economic events all which has affected the human lives in one way or another. This is how forex history shaped the economic ups and downs globally.

For instance, World War 1 significantly impacted the economy of Germany, which left it with a depressing economic future.

Major impactful events in Forex History

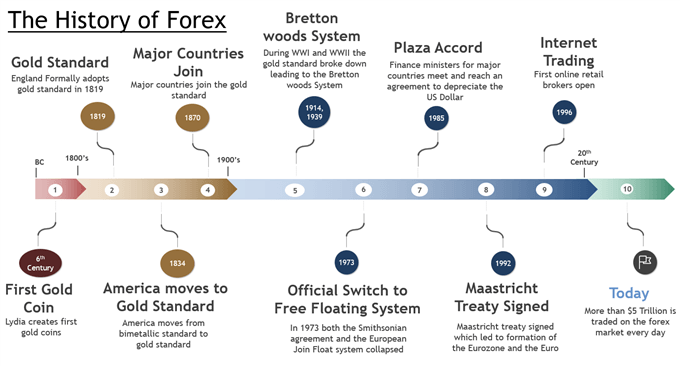

There were five major impactful events which took place in forex evolution

1. The Bretton Woods Accord

This was an agreement that was discussed and fully negotiated in July 1944. It established the new international monetary system by delegates who came to from 44 countries.

The event was held at the United Nations Monetary and Financial Conference.

In the accord, the currencies were attached to the US dollar valuation and later attached to the price of gold. In the early 1970s, The Bretton Woods system came to an end. President Richard Nixon announced that the US was no longer going to exchange US currency for gold, which was the primary purpose of the accord.

However, these three-pointers were noted;

- That the new International Monetary system was invented and lasted for close to 30 years.

- That the agreement was pegged on the value of other countries currency, but later attached to the price of gold.

- That after the collapse of the agreement, countries had the freedom to choose other ways to equate their currency with. Read more about this agreement here

2. The Beginning of the Free-floating System

When the Bretton Woods agreement came to an end, a new deal in the name of Smithsonian took over in December 1971.

In as much as the agreement was quite similar to the Bretton Woods, it gave room for more flexibility in terms of forex exchange rate band for the currencies in question.

The US pegged the dollar to gold at $38/ounce, which lead to depreciation of the dollar.

However, The European community tried to work out from relying on the US dollar in 1972.

This led to the establishment of the European Joint Float, that was established by France, the Netherlands, Belgium, West Germany, Luxemburg, and Italy.

The same mistakes that were experienced in the Bretton Woods were again repeated, and in 1973, the Smithsonian fell. This lead to the switch of the Free-floating system.

3. The Plaza Accord

This was a joint agreement that was effected by France, West Germany, United States, Japan, and the United Kingdom on September 1985. It was arrived at in a bid to depreciate the dollar since it had appreciated at a higher rate to other currencies that were in the market.

The major players of the economy realized that third world countries were lagging in debt and could not fit the competition form the foreign investors.

This is how the Plaza Accord came into being.

4. Establishment of the Euro

During World War II, there was massive disintegration between countries.

In a bid to bring them back together, Europe fast-tracked separate agreements which could help the regions work together once again.

The most outstanding Treaty Maastricht conference was held in 1992 in the Dutch city.

The agreement helped to establish the euro currency exchange together with integrating the policies that would govern the foreign exchange security.

This was a significant milestone because the European Banks benefited a great deal because the exchange risk was mitigated globally. All in all the treaty has continued to be amended to fit the current trades of Forex.

Read more here; History of Euro Currency Market

5. Internet Trading

Online forex trading is the method in which traders transact on Forex through electronic and internet. Real-time transactions are done immediately giving the traders the firsthand delivery.

As the forex market gained momentum in the 1990s, the view of trade changed.

When internet trade came into course, a trader could click a button and get all the information in terms of prices.

Communication also became easy globally, and this became a sort of a free market, and emerging markets took momentum at a higher rate. These included countries like South East Asia and competitive forces became the order of the day.

This has led to the fall of spreads due to the unparalleled liquidity, while at the same time, online competition is the order of the day.

Internet trading has so far captured the international banks, stock markets, and merchants who have enjoyed profits than earlier on.

Conclusion

One of the essential things in life is to understand why something happened and avoid such pitfalls in the future.

When it comes to the economy of a country, it’s critical to weigh out the anticipated events and mitigate the risks before it happens.

Forex Trading can negatively impact a country during recessions, and it’s vital to speculate in case of economic uncertainty and in circumstances where the prices are unstable and get to know how they can be mitigated.