When we talk about the forex market size comparison with other markets, we come to know that for any business to thrive, there must be a comparison of how different types of businesses prosper and look for ways to counter their strategies.

Forex traders, in this case, keep on comparing forex market size and stocks to be able to identify which market is more viable at any given time. This is because forex and trade are somehow connected, though each one of them has its unique characteristics.

One of the most appealing thing in forex is that it is a profitable business to carry out once you identify the market niche and also be able to interpret the trends.

Besides, the forex market dominates all other financial markets globally due to its sufficient liquidity.

Still, starting this trade is easy; one can start trading at around $200 and start making profits as you continue rising as the day’s business takes place.

What is the importance of comparing forex?

Once traders get to understand the similarities and also the differences, they can make informed decisions in relations to the factors that affect forex and other markets.

Some of these factors include Volume, liquidity, and also the market conditions prevailing as at the time of trading.

It is worth noting that in absolute size and as a global currency market, forex takes the most significant portion in the financial field players. Forex market dominates all other financial markets due to its unique features which the other markets have not enjoyed to date.

Differences of Forex with other Markets

Below are some of the differences that make forex dominate the financial market in comparison to others.

1. Volume of the market

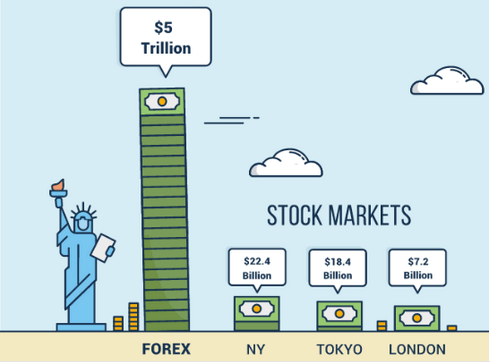

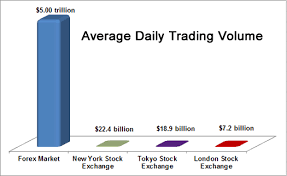

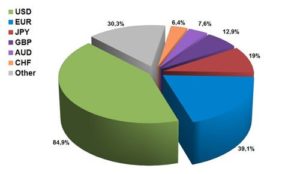

According to the Triennial Central Bank survey in the year 2016, the results indicated that Forex and Over the Counter End product, the daily turnover amounted to $5.1 trillion. This was necessitated by the US dollar, which has dominated the rest of the currencies over time.

According to the Triennial Central Bank survey in the year 2016, the results indicated that Forex and Over the Counter End product, the daily turnover amounted to $5.1 trillion. This was necessitated by the US dollar, which has dominated the rest of the currencies over time.

On the other hand, the New York Stock Exchange in the same period traded the stock markets, and the daily turnover was about $40 billion. Forex market volume is a vast difference, which makes the forex business more sustainable and drives with ease in a day’s trade.

The essence of high-value operations helps the business to transact more efficiently and at the same time set the prices that are comfortable for the trades without much of negotiation.

2. Liquidity

Any time where the stocks are involved, it means that one is buying companies shares, and this is determined by the number of shares that are available at any given time. Depending on the demand or the supply of the stocks, the prices will be rated differently.

Any time where the stocks are involved, it means that one is buying companies shares, and this is determined by the number of shares that are available at any given time. Depending on the demand or the supply of the stocks, the prices will be rated differently.

However, when it comes to forex, one may find that there are price fluctuations in his own country, one can opt to trade in other currencies that are placed in the market.

This makes forex better since you can trade with a variety of currencies throughout the day. In short, forex business does not stop because of a variation in one currency.

On the same note, forex traders can enter or leave the market and enjoy the fair prices for the time they will trade.

3. Accessibility to the market

Since forex is an over the counter market, it means that traditional means of exchange no longer exists and trade is made easy through interbank in a short period.

On the same note, currencies have greater access than other financial markets, and this becomes easy to trade for 24 hours a day, and five days a week. Markets such as the stock markets find it hard to penetrate in the markets due to limitations of brokerage personnel. This is because most stock markets trade between 9.30 a.m. to 4.00 p.m., which is far fewer hours compared to a 24-hour market drive experienced in forex.

In forex, no matter the zone that one is in, it’s a trading zone.

4. Lower transaction cost

This happens to be one of the critical factors that makes forex more unique than other financial trades. For once, forex trading has been considered as cost-efficient because most of the forex accounts have the option of trading without commissions, data licenses, and fees.

In most of the other markets, there is a mandatory requirement to pay the brokers commissions and the spread.

5. Greater regulatory freedom

Whereas there are fewer regulations when it comes to forex trading, stock markets have many rules which limit trade of stocks more flexibly.

Whereas there are fewer regulations when it comes to forex trading, stock markets have many rules which limit trade of stocks more flexibly.

Forex is a global trade; fewer regulations are imposed to pave the way for countries to exchange their currencies.

In the long run, make profits, which is always a welcome note when a business thrives in profitability.

6. The rise in technology

Over the years, there have been changes in technology, and Forex business has not been left out. Internet trading has taken a tall order and software’s to perfect the trading have also been enhanced. An example is the Meta trader 4, where even the small scale traders can interpret the forex data without many challenges.

In such cases, one can analyze the technical analysis by use of charts and make decisions which are profitable in the long run.

However, it is essential to remember that forex trading is a volatile market,

One ought to consider factors such as the economy, political interferences, and make decisions before taking a step.

When all these factors have been said, it’s important to know then, what forex analysis helps to make it a successful trade.

- Fundamental Analysis- This is where a trader should keenly look at the supply and demand of the currencies at any given time. The main factors that determine the fundamental analysis decisions include inflation, economic changes, political environment, among others.

- Technical analysis- In technical analysis, charts help traders to analyze the movement of the day’s trade and make informed decisions on what currency to trade in and make a kill at the end of the day.

- Financial Management- Any businessman should take note on money management at all costs. Understand the risks involved in a business and measure the risks thereon. Also, understand how the risks can be mitigated to ensure that the trade is rewarding at the end.

Most importantly, a good forex trader will keep updating himself with the trending news and equip themselves with as much information around the globe as possible due to large forex market size. This will keep one floating the whole year-round.