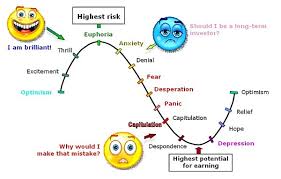

A proper mindset and trading strategy have a direct impact on financial trading. Many failures and frustrations experienced by traders results from emotions in trading.

Controlling your emotions will make the difference between your successes and failures. This calls for effective strategies, as discussed within here, to effectively manage trading emotions.

Emotions in Trading

Successful traders have mastered the art of controlling the trading emotions: Fear, FOMO, Greed, excitement, and losing.

Here is a quick recap of the emotions:

The emotions of Fear

The emotion of Fear often prevents traders from achieving their financial goals. Besides, fears lead to impulse reactions resulting in losses and frustrations.

More than often, fearful traders hesitate in taking profits, exiting or entering a trade.

Also, as Fear grips a trader, panic selling becomes the norm in a trade. Fear often cloud your judgments and abandoning of trading plans.

The emotions of Greed

Perhaps you often find yourself wanting more from a profitable trade or engaging in substantial win trades or risking more for a bigger profit. For sure, this is a sign of greediness.

Be very careful as the emotion of greediness will often lead you to huge losses and a gambling trap. Also, greed negatively affects your Forex trading profits emotions.

Excitement

How do you feel when you win a trade? Very happy, I guess.

Excitement often misleads traders to believe they are on a winning lane.

As a result, without even glancing at the trading strategy, you continue the excitement and increase your risk anticipating big wins or participate in many trades hoping for more wins.

Before you burn your fingers, take a break, and put your excitement under control.

Fear of missing out (FOMO)

FOMO’s emotions will encourage you to participate in many trades as you worry about losing out on the opportunity to be in a winning situation.

Like the effects of the other emotions in trading, FOMO leads to more losses and abandonment of trading plans.

The Fear of losing

The Fear of losing your capital could motivate you to embark on revenge trading as you try to recover your losses.

The market does not care about your emotions, and you will end up losing more money while nursing mental anguishes from lose emotional trading.

Controlling Emotions in Trading

Every trader must learn how to manage emotions in trading for profits and a peaceful mind.

Lose emotional control process requires dedication, willingness, and self-discipline.

Here are strategies to help you develop a positive mindset to minimize emotional trading:

Trading plans

The longstanding saying “failing to plan is planning to fail” holds in every situation. Planning is the key to controlling traders state of mind.

Your trading plans should include;

- Risk/reward tolerance level

Emotional trading can be managed effectively by initiating a risk/reward minimum ratio of one to one.

For instance, if you risk a $100 in a trade ensures a profit of at least $100 if the trade wins.

Also, the necessity of trading within your risk tolerance limit should not be overlooked

- Trading strategy

As you learn to discipline your emotions in trading, remember that successful trading must

(1) have a trading strategy, and

(2) strictly stick to trading plans.

Have a good strategy to minimize losses while protecting your capital and profits.

Relax

Remember the adage, “all work without play makes Jack a dull boy.”

Well, this saying applies to traders state of mind. Find time to relax your minds to minimize emotional trading.

Physical exercise, jogging, swimming, nature walks, and weekend getaways are some fun ways to relax and rejuvenate your emotions in trading.

Self-discipline

The professional traders will emphasize to you the importance of self-discipline in financial trading.

Adhering to tolerance limits and trading plans require a high level of self-discipline.

Besides, self-discipline entails following your rules and filing a trading journal consistently.

Education

The importance of self-confidence should not be undermined in Forex trading.

With the advancement of information technology, self-education in Forex trading is now cheap and widely available.

And, the role of education in developing self-confidence cannot be overstated either.

Reading and attending conferences and seminars increases the confidence and trust in your trading abilities.

Never underestimate the importance of testing and practicing your acquired knowledge and skills at the free demo accounts.

Importantly testing and practicing will sharpen your trading skills while boosting your confidence

Trade in the right market condition

The importance of trading in the right market condition should not be ignored at all costs.

Don’t participate in a trade just for its sake, but look for markets that you feel are right for you.

Always stay away from markets if your gut feeling tells you it’s not worth the risk.

Forcing yourself to trade and then lost only adds more frustrations and losses to you.

Must Read: Why is trading Psychology important

Acceptance

Enjoy many happy trading sessions by treating Forex as a business venture where profit and loss are the probable outcomes.

Whenever you lose in a trade, accept the loss and move on to the next trade.

Winners control their loss while losses control losers.

Don’t Gamble

While financial trading has probable win or loss outcome, it is not gambling, as might be wrongly perceived by beginners.

Differentiate between the two – financial trading involves fundamental and technical analysis while gambling is purely a game of probabilities which is highly addictive motivated by Greed.

Whenever you find yourself continually trading without a strategy in many trades and increasing your trade size, you are gambling.

Thus gambling therapy is your best solution as you think of exiting Forex trading.

Do not Follow Trends

Discussions and opinions in groups, forums, or communities could be a noble idea.

However, some of the opinions could be personal views not supported by a market analysis that could potentially develop into the following trends.

Then it is vital to avoid being swayed by such public opinions by sticking to your trading strategies while having confidence and trust in your trading abilities.

Conclusion

Understanding and implementing the strategies discussed in this article will effectively assist you in being a better trader.

Remember, successful trading is characterized by a good trading strategy and effective control of the emotions in trading.

As you embark on the journey of emotional control, it is essential to evoke willingness, determination, and patients.