It was a hectic trading week as market volatility was quite high. Today we are going to discuss the NZDUSD trade that I took on 20th April 2020. However, I could not write about it for being very busy with trading, as well as a few other work-related matters.

Finally, I got a chance to sit down and share my experience with this trade today.

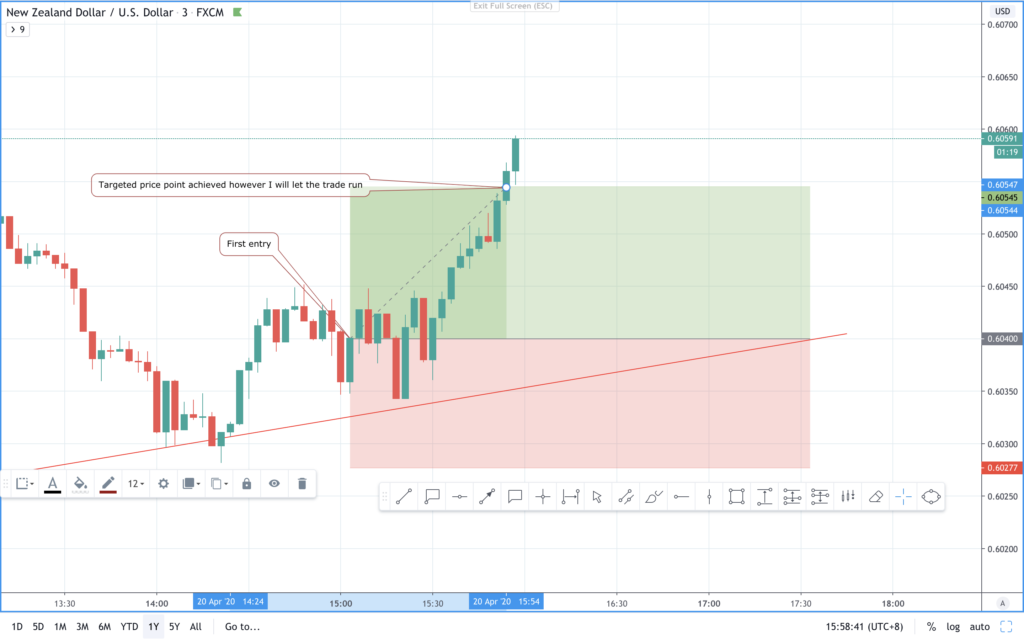

It was a beautiful trading day with good bullish momentum for the short run. As per my nzdusd analysis, before entering this trade, this bullish trend was dominant but only for the short term. I was monitoring this trade since 13:00 GMT + 8, and after hunting for a good 90 minutes, I finally spotted an excellent entry for a buy, as shown in the image below.

A good beginning for forex pair NZDUSD

Trade started performing right after my entry (that’s my foremost preference to find trades that are ready to go, rather than entering a trade too early and go through this waiting period. I rather wait and keep hunting for the spot which is prepared to go than entering a trade too soon and wait for the trade to perform).

Now I will be honest with you, it does not happen all the time, but most of my trades are like that where I enter them when they are ready to go. But sometimes, if I know I probably have other things to do for the day, I may open a trade that requires further time to perform. Today’s example is one of those examples where I took my time for the exact hunt; however, after entering the trade, I did not monitor nzdusd signal to profit from the same trade again and again.

Back to the trade, my first targeted price point was achieved within approximately one hour time, as shown in the image below. I did not close the trade and let it run it, and I set my next targeted price point and left my desk to run some errands.

BULLS are in control, NZDUSD

Within another hour’s time, my second targeted nzdusd price point was achieved, and I got the notification on my phone (Another tip, even if you are away, try as much to stay connected to your trades. The best way to do is to set some notifications in your trading system for multiple possible price points that you think the market could move to).

So at the time, I got the notification I decided to leave it as it is because I was in the middle of doing something. Generally, once my targeted price point is achieved, it does not mean to exit the trade, nor it means to leave it. It simply means that we are in an area of interest for the opposite party, and its time to get back to the desk and start observing it closely. And here is the reason I set my targets based on possible areas of interest for bulls and bears.

Time to Panic? bears started challenging bulls –NZDUSD

Anyways, I decided to leave it as it is, and by the time I got a chance to look at my trade again, it was in a pullback phase, and it was a deeper pullback. I did not get panic, Never get panic, and that is only possible if you have done your homework correctly. If you know what to expect, you probably will be more relaxed.

Usually, when traders see a pullback, they start getting panic, which makes them make bad decisions about their trade. What we need to understand is that pullbacks are not a bad thing; all we need to do is to see how pullbacks are doing.

If we can master this one mindset technique, it can make a huge difference in your trading experience. Matter of fact is that this trade pulled back down to my area of entry as well, and you see that in the image given in later part of this article.

I was still out of my office and did not have access to my work station. One thing I don’t like to do charts analysis on my phone, you can still monitor your trades from your phone, and even follow charts, but you can’t do your analysis from your phone.

If you want to be a full-time trader, you need a properly working machine. By that, I don’t mean fancy multiple displays or anything. It simply means a good enough 13 inches display, which could be a laptop or anything you are comfortable with.

For the trade, around 21:00 GMT+8, it recovered from the pullback, as shown in the image below.

Missed opportunities – NZDUSD

Now, if you follow my trades, you must have observed that I always like to re-enter the same forex pair, again and again, every time I get a chance. And in this example, there were very nice 2 to 3 entering price points, however, since I was not in front of my computer, so I could not benefit from those entry points.

Results:

Around 22:45 GMT+8, I finally decided to exit the NZDUSD forex pair, as it made a slightly higher of my previous targeted price point. At this moment, I was expecting a reversal because of the last pullback showed good bearish momentum. Also, it was a long day for me, and it was time to call the day off. Overall decent trade helped me pocketing 44 PIPS.