EURCAD Live Trading Experience

Today we are going to discuss a trade I initially took on 28th April 2020. It was an excellent trading setup for shorting EURCAD.

The price point I spotted to enter the market was just lovely. I anticipated the eurcad pip value to move for a decent number of PIPS, so I left the trade run without monitoring it much.

I was initially not trading EURCAD on that day as I was following and buying another two forex pairs. That’s why if you see I missed another potential entry after the first move, but that’s alright.

You can see how this trade performed in the image below. It gave me descent 60 PIPS.

Now, here is a tip for my readers and learners, “One thing I do once I have finished analyzing the overall market for the day – I analyze my previous day trades, and I examine how they performed when I was not around.”

It is always much more convenient to enter the forex trading currency pairs that you were trading yesterday, as most of the market analysis was already performed.

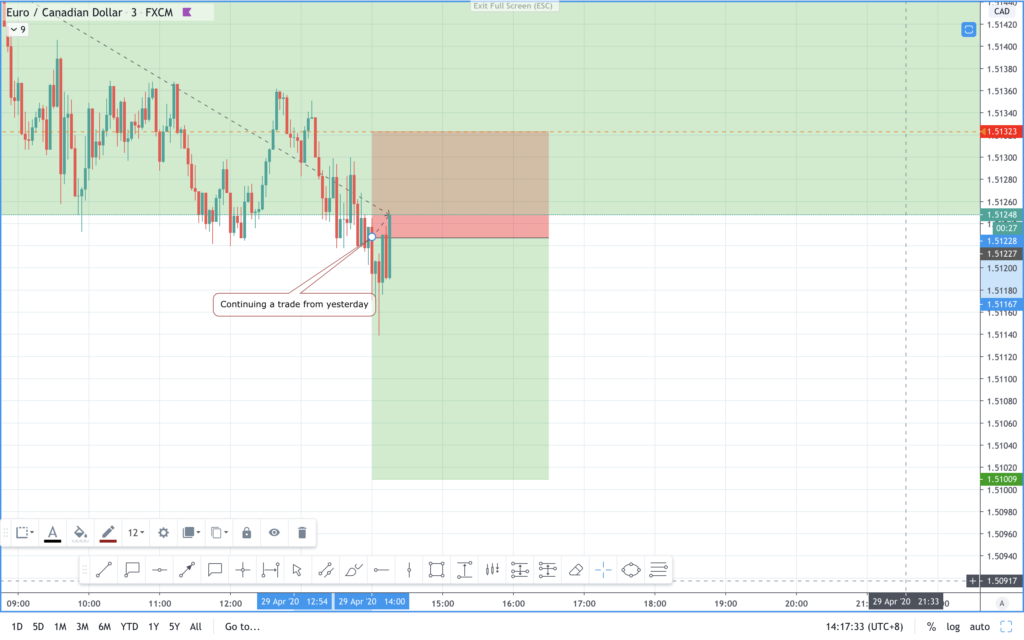

If there are good trading setups, it’s much better to enter the same pair. So I did the same thing I spotted an entry point next day afternoon (GMT+8), you can see my entry below.

The market started moving in the opposite direction, and it kept moving in the opposite direction for some time.

If you see the eurcad signal in image below, you will know that it even crossed my expected price point in the opposite direction.

However, my stop losses are always soft stops, I never put a hard stop for any of my trades. And I only do it because I closely monitor my trades like a hawk, I literally monitor every single move it makes.

I am not suggesting that you should do it as well, Its just my preference. I only put a hard stop when I am away from my table.

The price moved much deeper, and according to my eurcad forecast I saw it as another opportunity to grab a better price for the next entry. You can see my next entry below in the image

Later around 22:30 (GMT+8), I closed both trades. First trade gave me descent 29 PIPS, and second trade gave me 46 PIPS.

By that time, it was late for me; however, I was not done with my trading day yet, even though I was exhausted. So I did something which generally I would never do.

I entered the market again a few minutes later after closing my trades, this time, I set a hard stop for my profit and loss and let the trade run. I called the day off and went to bed.

I would be honest with you, I was very uncomfortable doing it, but it’s just some of the days you do things you generally don’t do. Bad habit.

The next morning when I woke up, the first thing I did was to rush to my laptop to check out my trade, and it made me happy to see my forex entry was closed at my take profit point.

That was nice to see. However, I told myself never to do it again, it’s still a bad practice (at least in my opinion).

You can see the trade in the image below, later in the afternoon, I entered the forex pair EURCAD again one more time, and after analysing eurcad on tradingview I knew this probably is the last trade for this pair, as momentum was drying up.

Later around 21:00 GMT+8, I exit the trade by making descent 43 PIPS.

Overall results:

It was an excellent eurcad live trading experience as it helped me pocketing 178 PIPS overall from one single pair over less than 72 hours.