The portfolio of forex trading strategies that you use will set you apart from other traders. Seasoned forex traders also know that using just one strategy won’t always produce the maximum number of successful trades.

As we step into the year 2020, we want to highlight 10 of the most effective forex trading strategies that you can use to rake in more profits. Don’t forget that you’ll become a successful trader only if you can apply and adapt these strategies appropriately depending on the prevailing market conditions.

1. Price Action Trading

Price action trading is one of the most frequently used forex trading strategies. It’s also a powerful and simple ways of getting an edge in the forex market.

In price action trading system, the trader formulates a technical strategy after studying historical forex price movements. Price bars are the most commonly used indicators. The observed price movements as well as support and resistance levels often offer vital clues on where the market is most likely headed.

Price action was used by Jesse Livermore, a legendary trader who in 1929, was worth more than $100 million. In Livermore’s words, “when it comes to markets, something which happened in the past is bound to happen again because humans drive the market, and the nature of humans never changes.”

All price action traders use raw price data to analyze and predict forex market trends. However, there are several different price action strategies that one might use—and each has its merits and demerits.

Pros

- It’s a time-tested strategy

- It provides near-accurate, profitable and relevant signals for trending and range-bound markets

- It’s simple. Thus, it’s easy to decide when to enter the market, and you don’t have to deal with tons of technical indicators.

Cons

- Takes time and requires patience as you’ll wait for confirmed support/rusticate status

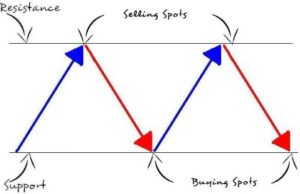

2. Range Trading Strategy

Forex markets don’t always display a definite trend. About 70% of the time, forex markets trade in a range. A Range Trading Strategy in forex occurs when the market moves consistently between two prices over a definitive period. It can happen in all time frames both long-term (e.g., daily and monthly charts) and short-term (e.g., five-minute charts)

In range trading, therefore, a trader may either go long or short depending on the current price position within the range. To trade, the trader must first identify the range they wish to trade in. This is best done by analyzing support and resistance areas.

Next, the trader looks for an ideal enter position based on whether they wish to go short or long. Other indicators like RSI (Relative Strength Index), CCI (Commodity Chanel Index), Stochastics, oscillators, and others may be used to confirm market conditions.

Pros

- Trading in a range may give you multiple winning trades before a breakout occurs.

- Some currency pairs have ranged for years, thus using range forex trading strategies may pay off in times when such currencies are ranging.

Cons

- Long-lasting ranges do not happen very often. And when they do, they can get crowded.

- Not all ranges are worth trading in– some are just too narrow to produce significant profits.

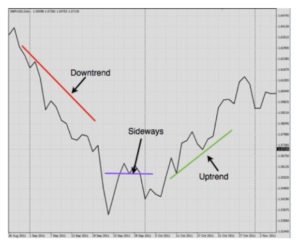

3. Trend Trading in forex

The trend in forex is your friend, as long as you exploit that trend to your advantage. Trend Trading in forex market generally refers to the overall direction (either up or down) that the price is moving.

Dow theory states that uptrends generally occur when a series of higher highs precede a series of higher lows. Conversely, a series of lower lows preceding a series of lower highs constitute a downtrend.

All markets, including currency markets, are somewhat predictable. Seasoned trend traders, therefore, use several indicators to identify and analyze the direction of forex market momentum.

These traders can then forecast what’s most likely going to happen and modify their forex trading strategies based on their predictions.

Identifying a trend is easy, and the scale of a trend doesn’t always matter. However, to profit from trend trading, it best to enter right at the start of a trend or after it’s just started as opposed to entering just as the trend is coming to an end.

Pros

- As long as your forex trading strategies are in the trend’s direction, the forces driving the trend will often end up working in your favour

- Strong trends are often associated with big profits

Cons

- It’s easy for news and economy events to kick trend traders into huge losses

- There’s usually a big learning curve before you can confidently trust a trend.

4. Position Trading Strategy

Position trading strategy is one of the forex trading strategies that only work for the super-patient, long-sighted traders.

A position forex trader holds his or her position for a long time. The holding period could be several weeks or even years. By entering and remaining in the market for extended periods, the trader hopes to capitalize on any strong pricing trends that occur.

Position traders look for big runs that may play out over multiple weeks or months. They do not concern themselves with minor, transient price fluctuations or pullbacks. Instead, they focus on the bulk of an existing trend.

There are several different approaches to position trading in forex. While some traders may go for currencies with a strong trend, some opt for currencies that haven’t started trending yet but have a strong trending potential.

Thus, for most of the part, position trading involves looking for and anticipating trends. To achieve this, a position trader may look at chart patterns, fundamental ratios, technical indicators, news catalysts, and several other indicators.

Pros

- Little maintenance- since position traders are often playing the long game, they don’t have to actively monitor their open positions on a daily basis, like in other forex trading strategies. After the initial research is complete and the trader has entered the trade, there’s little else left to do but wait. The position only needs to be monitored on occasion.

- Mitigates “noise”—position traders aren’t concerned about short-term volatilities that may occur in the market.

- Position trading helps a trader capitalize on robust trends

Cons

- Lack of compounding- a position trader will realize gains only after their position is closed which could take weeks, months, or years. This limits the ability of a trader to compound returns for the duration that his/her position is open

- Account liquidity- the trader can’t use the money invested in their open positions. That money isn’t, therefore, available to pursue other opportunities or forex trading strategies until the position is closed.

5. Forex Day Trading Strategy

Most forex trading beginners often gravitate towards trading on an intraday basis. This is what forex day trading strategy is all about—opening and closing positions on the same trading day.

A day trader may apply several other forex trading strategies to ensure that they reap the most profits from the price fluctuations that happen during intraday forex trading. Thus, day trading isn’t just one type of trading. A day trader may, for instance, switch between, scalping, and position trading among hundreds of other day trading strategies.

In addition to having substantially good knowledge of the market and the currencies you trade, day traders must also invest a decent amount of their capital if they are to be successful.

Additionally, major currency pairs often make the best markets for day traders because of their high trade volumes.

Pros

- Eliminates the needs to pay Swaps—the fee charged to keep a forex position overnight.

- Day trading allows you to use several forex trading strategies, which may, in the long run, give you a positive edge.

Cons

- Intraday currency markets can only move to a certain extent in one day. Hence, profits can be limited.

- May require the trader to be present throughout the trading session.

6. Scalping in forex

Think of scalping as a short, fast-paced action thriller that keeps you on the edge of your seat! Scalping in forex is just as intense. Scalping is one of the few forex trading strategies that help you to stay wining at all times by raking in small profits each time the market is favourable.

A scalping trader tries to grab a small number of pips as many times as they possibly can throughout the forex trading day. He/she does so by opening and closing several times intraday. This is possible because a scalping trader only holds their position for just a few seconds or minutes.

Scalping requires both quick thinking and intense focus. One will, for instance, have to stay glued to their charts and closely monitor their scalping indicators throughout the trading period.

Pros

- Scalping strategies try to limit losses and maximize profits

- These forex trading strategies are non-directional and can work whether the market moves up or down

- Scalping strategies are some of the easiest to automate

Cons

- You’ll need higher minimums to participate in scalp trading

- Scalp trade transaction costs are also significantly high compared to other forex trading strategies.

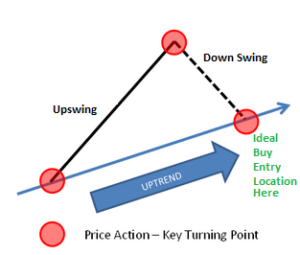

7. Swing Trading Strategy

Swing traders identify swings within a trend and enter when they think there’s a high probability of making considerable gains.

If, for instance, a particular currency pair displays an uptrend, the swing trader will go long (buy) at “swing lows” and go short (sell) at “swing highs.” Unlike intraday forex trading strategies, however, swing trades may extend past one trading session. Since most swing traders have a target of the earnings they wish to make, they’ll try to lock in their profits over several days.

The goal of swing trading strategy is capturing a chunk of the price movement (be it for the more volatile pairs or, the more sedate ones) and then moving on to wait for the next opportunity that may arise.

Swing trading requires the trader to routinely monitor technical and fundamental indicators so that they are able to determine the best time to enter, when to place a stop loss and to even predict how much profit they can get out of the trade.

Pros

- Helps you maximize the potential of short-term gains by capturing the bulk of currency swings

- It’s possible to only rely on technical analysis during the trading process

Cons

- Swig trading is subject to the risk that comes with holding trade positions overnight and over the weekend.

8. Forex Carry Trade Strategy

Here’s an interesting fact about carry trading strategy. It’s a trading strategy that can provide gains even when currency prices remain the same over long periods.

In carry trading, a high-yielding currency rate is invested in a low-yielding currency rate through a strategy that leverages the difference between those two rates.

However, carry trades involving major currency pairs don’t provide the type of profits they once did in the past. Consequently, most forex carry traders frequently go out over the risk curve to trade in high-risk, high-yield emerging markets.

Pros

- In addition to your trading gains, carry forex trading strategies may also give you considerable interest earnings

Cons

- There’s a big risk for loss if exchange rates and currency prices move against the trader’s expectations

9. Support and Resistance Trading

Ideally, every forex trader should be able to spot the levels of support and resistance for the various currency pairs they are interested in. This is primarily because support and resistance are useful indicators of the sentiment of the currency market and ultimately affect almost all other forex trading strategies.

Typically, prices start falling in an area where support develops and stop rising when resistance occurs. Support and Resistance Trading trends can be minor or major. Minor trends break after a short, whereas a major trend will hold and affect price movement over an extended duration.

Support/resistance traders, therefore, decide when to enter or exit the market based on the current or expected levels of support. One may, for instance, buy near support or sell near resistance.

Pros

- It’s easy for an experienced trader to predict price movement through support/resistance analysis

Cons

- False breakouts occur on occasion and may mislead a trader leading to significant losses

10. Long/Short Hedging Strategy

Sometimes, even after analyzing the core market indicators, taking into account all potential risks, and making the best possible decisions, market conditions may simply go against you.

That’s why sometimes traders create use hedge forex trading strategies where they go both long and short on a currency depending on the nature and strength of the forex market. This way, profits from a long position may offset losses from a short position and vice versa.

Pros

- The Long/Short hedge strategy may help the trader recover losses when trading in volatile currency markets.

Cons

- Requires substantial capital investments since loss is inevitable for one of the positions (either long or short)

Summary

Successful forex trading requires that the trader considers multiple factors to formulate one or more highly effective forex trading strategies. While the outcome of any single strategy isn’t 100% guaranteed, the 10 forex trading strategies we’ve described above have the highest success rates.