As a forex trader, you must have heard the word pips or forex pip; those are some of the commonly used words within the foreign exchange community.

Having the right information and knowledge about pips is vital to everybody who wants to make it in forex trading.

If you are not comfortable with pips, don’t even consider going into forex trading.

In this article, we are going to break down everything you need to know about pips, how to calculate it, and how to determine your profit and loss.

Concept Of Pip In Forex Trading

Pip stands for percentage interest point. In forex trading, pip is the primary unit of measurement.

This unit is typically used to indicate any smallest change in the rate, and it’s also used when relating to currency pairs.

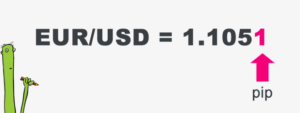

In the fifth digit of any exchange rate, a pip is used to identify any change of one point.

If you apply this to most currency pairs, a pip indicated any change that happens in the fourth digit after the decimal point. That is 0.0001 the pip here is 0.01%.

Let’s use EURCHF currency pair for example.

If the first exchange rate is EURCHF = 1.0939, and the second exchange rate is EURCHF = 1.0940.

The difference between the first and second rates, in the example the pip is 0.0001, which is one pip (0.01%)

It is also important to note that a pip is a relative value. You need to know the following to determine the exact worth of a pip — the exchange rate, the currency pair, and the amount that is traded.

When determining the absolute value of a pip, the amount been traded has to be considered. This means if a trading volume is an exchange at 100,000 euros, ten Swiss francs would be one pip. And if it’s 10,000 euros, one Swiss franc would be one pip.

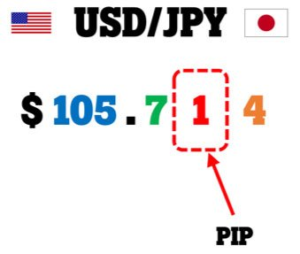

When trading with currency pairs like the Japanese Yen, for instance, CHFJPY. A pip change appears in the second decimal place.

The reason for this is, when it comes to Yen, there are three digits before the decimal point. Unlike others, the second decimal point is after the fifth digit.

For example: CHFJPY = 114.61.

Explanation Of Pip With The Help Of Forex Quote

Explanation Of Pip With The Help Of Forex Quote

A forex quote is simply the price of one currency in terms of another currency.

It essential to understand that when it comes to quotes currency pairs most always be involved. And the reason for this is, you will be buying one currency in other to sell another currency.

For instance, if the price of one Euro is $1.1404 when viewed in the EUR/USD currency pair.

Under stable market conditions, brokers will receive the difference between two pairs while they quote the two prices for the currency pair and

In forex, quotes reflect the price of various currencies at any given time. It is crucial to have a good understanding of how currency pairs are read.

This is because as a forex trader, your profit or loss will be determined by the movement of the quote.

What is a Fractional Forex Pip

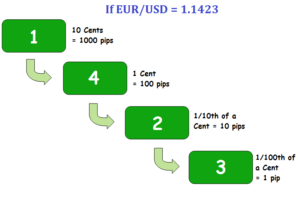

When it comes to fractional pip, it is merely the one-tenth of a pip. Sometimes, fractional pips are used to describe the fluctuations that occur in forex rates precisely.

Fractional pip can also be called Pipettes.

Fractional pips are shown in the sixth digit of forex rates. On most forex trading platforms, fractional pips are displayed in subscript.

To get a better understanding of what we are discussing, the following is an example of fractional pips using the EURUSD exchange rate.

Our first example the exchange rate is EURUSD = 1.09386, and the second example the exchange rate is EURUSD = 1.09388

In the above examples, the EUR/USD moved from 1.09386 to 1.09388, that 0.00002 USD move higher is two fractional pips.

How To Calculate The Value Of a Forex Pip?

To calculate pip value, all you do is multiply one pip (0.0001) by your specific lot size.

If it’s a standard lot, it is 100,000 units, and for mini lots, it’s 10,000 units.

To explain this, using EUR/USD, when one pip moves in a standard contract are equal to $10 (0.0001 × 100 000).

If you are a trader calculating the value of a single pip helps you to put a monetary to your take profit and for stop loss.

Because of that, traders can now determine how their trading account value will fluctuate when the currency market is moving.

One other vital issue to note that is, the value of one pip always differ for every currency pairs. The reason for this is the value of one pip is different when trading other currency pairs.

If you are trading EUR/USD, the value of one pip is displayed in USD, and if it’s GBP/JPY, it will be shown in JPY.

Calculations Of One Pip By Example

This is how you calculate pip value; for instance, if GBP/USD is trading at 1.5000 market price, your mini lot is 10,000. The value of a forex pip will be calculated as;

(0.0001/1.5000) × 10,000 = 0.6666

What this means is for every pip that moves, you will make or loss 0.6666 pounds in your trade.

If you are trading spot forex, the quote currency is what defines the value of the pip.

In this example, we will be calculating the value of one pip movement using USD.

10,000 x 0.0001 = 1

In the example above, for every pip that moves, you will generate $1 of profit or loss.

Alternatively, you can also multiply your pip value by the current rate in the exchange market.

Pip Value Alteration For NON-USD Account

When trading and account, if the currency is listed as second in the pair, the mean the pip values will be fixed.

For instance, if you are trading a Canadian dollar account (CAD), that is XXX/CAD, that means USD/CAD will have a fix pip value.

And the standard lot will be CAD 10, while the mini lot will be CAD 1, and the micro lot will be CAD$0.10

Exclusion Of Forex Quote – USD/JPY

Whenever you want to trade against the Japanese Yen, then the pip will no longer be the fourth decimal; instead, it will be the second decimal.

The reason for this is because the Japanese Yen is much lower in value than most major currencies.

When you are trading mini contracts (10k) and standard contracts (100k) in Japanese Yen, the value of one pip in that trade will be JPY100 and JPY1000.

Conclusion

In the foreign exchange market, most trading frequently happens among the Japanese yen, the British pound, the U.S dollar, the Canadian dollar, and the euro.

As a forex investor, you need to have an understanding of some of the basic terminology of forex trading before you start trading.

In forex trading, an investor is continuously buying and selling currencies.