One way of looking at the structure of forex trading is that all exchanges occur through middlemen (brokers) who charge for their services. This charge is one of the key competitive assets offered by most forex trading platforms—and it’s referred to as forex spread.

It’s crucial for you, the trader, to understand how forex spreads work because the cost of trading in currencies will primarily be based on spreads—and that total cost will, in turn, affect the overall outcome of a forex portfolio.

what is spread in forex?

It’s easy to understand what spread in currency trading is if you imagine what goes on in any other ordinary trading operation.Take buying clothes for resale as an example. The trader buys the clothes at one price and sells them at a different rate.To make a profit, his selling price ought to be higher than the buying price.

In our example above, the clothes trader’s income is the difference between his original buying price and the price at which he resells those clothes. Spread works in a similar way, only that it’s the forex broker who receives the income in forex trading.

How Does the Forex Spread Work?

A typical forex broker may make money in several ways, including spreads and commissions.

It’s mostly the STP brokers who get their income primarily through spreads—STP stands for Straight Through Processing.

When you make a trade through an STP broker, it is processed automatically through the broker’s group of banks and liquidity providers. The process will yield a bid and ask price.

Usually, the broker will buy the currencies from the banks at one price (bid price in forex). It makes more sense if you imagine that your broker is bidding to buy those currencies from the bank.

The broker will then add a spread to the bid price and offer the currencies to forex traders at a new, slightly higher price (ask price in forex).

How to Calculate Cost of Forex Spread

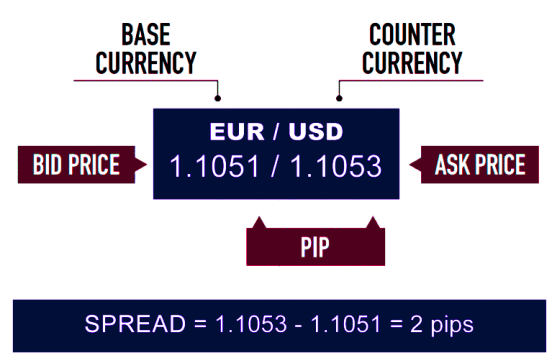

A currency pair is made up of base currency (the one on the left-hand side) and quote or counter currency (the on the right). The rate of a currency tells us how many counter currency units can be bought with one base currency unit.

In a EUR/USD pair, EUR (euro) is the base and USD (US dollar) the counter currency. Therefore, if this currency pair is trading at 1.1209, it means that 1-euro costs 1.1209 US dollars.

✔ The ask price in forex, therefore, is the price at which the broker lets you buy the base currency

✔ The bid price in forex is the price at which the broker lets you sell the base currency

✔ The difference between the bid and ask price is the forex spread.

Assuming that the current hypothetical exchange rate for the EUR/USD pair is 1.1051/1.1053, the spread would be calculated by subtracting 1.1051 from 1.1053 (the difference between the bid and ask price) to give you a spread of 0.0002.

Forex market spread is expressed in pips. Since pip value is identified as the fourth digit after the decimal point, the final spread for this particular exchange may be expressed as 2 pips.

Types of Spread in forex

Whenever you open a forex position, you’ll eventually have to close at some time in the future. It doesn’t’ matter whether you were going long or short-selling; you’ll have to pay this spread to the broker.

Whenever you open a forex position, you’ll eventually have to close at some time in the future. It doesn’t’ matter whether you were going long or short-selling; you’ll have to pay this spread to the broker.

The cost of your spreads depends on your position size. Still, forex transaction costs are some of the lowest when compared to the cost of trading in other major financial markets.

There are several different types of forex spreads. However, the two most common ones are:

- Fixed spread

- Variable/floating Spread

Fixed Spread Vs. Floating Spread

Fixed Spread

Fixed spread denotes forex spread, which is constant and unchanging with respect to market fluctuation.

Most of the time, EUR/USD, GBP/USD, USD/JPY, and EUR/GBP pairs will have a fixed spread.

Advantages of Fixed Spreads

- A trader can rely on a particular strategy without worrying about fluctuating spreads

- Cheaper trading costs because fixed spreads call for smaller regulatory capital than variable spreads

- Traders can predict the cost of each transaction better

- It’s ideal for beginner traders

Disadvantages of Fixed Spreads

- You can almost expect requotes when the broker wants to make forex market spread adjustments to accommodate changing market conditions

- Won’t work during scalping

Variable/Floating Spread

Variable spreads are continually being adjusted by the forex broker to reflect market changes based on volatility and liquidity conditions. Most currency pairs have variable/floating spread

Advantages of floating spread

- No requotes- the spread accounts for market fluctuations

- Often comes with better pricing

Disadvantages of floating spread

- Associated with greater risk than fixed spreads

- Widens as liquidity increases; and actually, only narrows during market inactivity

Factors That Affect Forex Spread

Several factors may affect the magnitude of spread in currency trading, including:

- Trading volumes- higher trade volumes (i.e., increased trading in a specific currency) result in lower spreads and vice versa

- Current political and economic conditions- unstable economic conditions and/or tumultuous political climates will lead to a currency being associated with increased risk.The bid-ask spread for high-risk currencies is almost always high.

- Currency volatility- a volatile currency is more susceptible to changes in value, which drives the bid-ask spread upward.

- Broker’s policy- Spreads are how brokers make profit, and as such their maximum spread sizes may vary.

Why Is This Knowledge Useful?

- Trading Exotic Currency Pairs Can Be Expensive

Major currency pairs are usually heavily traded. Brokers and forex markets are also in stiff competition against each other to increase their market shares for these pairs. Consequently, major forex pairs have tight spreads. You’ll pay lower transaction costs when you trade currencies with tight spreads.

Exotic currencies, on the other hand, are less popular, which gives them less competition and liquidity. Hence, their spreads will be significantly high, and trading them might cost you more.

- It’s Cheaper to Trade During Active Hours

During the hours when forex trading is most active, the number of market participants increases, and competition is high. Spreads will naturally be narrow during these times because there are many buyers and sellers for a given currency pair.

Forex is usually most active during the overlap of the London and New York markets between 1200hrs and 1600hrs GMT. Price fluctuations are also most frequent during these times.

- Major News Release Can Affect the Cost of Trading

Usually, there’s a major news release for at least 1 one of the 8 major forex currencies. Once the release is published, price movement occurs, and there might be a resultant imbalance between buyers and sellers. These, and several other factors, may widen the forex market spread for a particular forex pair.

- Watch Out for Gaps

Gaps and wide spreads go together like salt and pepper. For instance, if an important market happens over the weekend, forex prices will open a gap lower or higher than when the market closed the previous Friday.

When such a gap forms, the spread in currency trading can be very wide, even reaching dozens of pips. This will definitely affect the cost of trading in such a session.

Key Take-Aways

- You’ll pay the spread only once per completed trade

- Spreads vary between different forex pairs

- The major, heavily traded currency pairs often have the smallest spreads.

- Larger spreads are frequently seen on the more exotic forex pairs

- Cross currencies, i.e., currency pairs that don’t involve the USD like the GBP/JPY may also have significantly larger spreads.

- Usually, forex spread will move a lot when there’s market turbulence or following a big news announcement.