The forex market is highly volatile, and over 78 % of traders make losses even though all aimed at profitability. And, if you are not careful, you, too, could easily lose your entire savings.

However, there is hope — good forex risk management practices to protect your capital while minimizing the losses.

Forex Risk Management

First things first, what is a forex risk? Forex trading risk is the exposure to risk in the forex market, while forex management encompasses the response to the forex risks.

There are several risks in forex trading, namely: risk of ruin, liquidity risk, interest rate risk, leverage risk, and market risk.

Managing forex risks is important as forex traders are constantly exposed to any or a combination of the above risks.

Experienced forex traders use forex risk calculators to manage trading risks best and to get the best lot size for forex.

Whether you are a beginner or professional forex trader, the following strategies will help you manage risks in forex trading.

1. Education and Practice

The first step towards successful forex risk management is to educate yourself on forex risks and trading. You can use educational resources such as forex articles, videos, and webinars to learn risk management.

Forex lot calculator, forex volatility calculator, and forex lot size calculator all available online are some of the handy tools you will encounter as you learn risk management in forex.

Before engaging your newly acquired knowledge and skills in live forex trading, make use of a free forex demo account.

Practice your new skills on the demo account until you are confident enough to risk real money.

2. Invest The Risk Money

As simple as it sounds, it makes sense or cents in any financial trading to only invest the money that you can afford to lose.

To their peril, many traders often assume this simple rule while falling into the temptation of quick and easy money.

Money set aside for other purposes such as rent, food, or school fees should not be treated as risk money. Taking such unnecessary risks will lead to problems.

First, you may end up losing your entire capital. While the temptation for quick and simple profits might overwhelm you.

Trading with non-disposable income results in emotional stress as you wait for wins. It’s okay to be optimistic, but wins in foreign exchange trading are not guaranteed.

Learn from the Consistent traders and only trade with your disposable income but also …

3. Trade Within Your Risk Tolerance

As you contemplate to start trading, you need to determine your risk tolerance level. A good tolerance level reduces losses while removing emotions in forex trading.

Being in control of your finances and investments is another benefit of trading within your risk tolerance. Determining the amount of risk leads us to the next step in forex trading risk management.

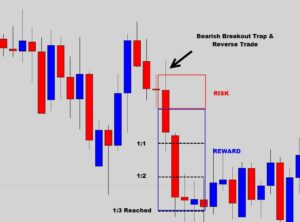

4. Fix Risk Reward Forex Ratio To At Least 1:3

Determining the risk reward forex depends on an individual’s risk tolerance. Most traders fix their risk-reward ratio at least 1:3.

The 1:3 risk reward strategy implies that for every forex risk you undertake, you expect to gain 3 times. Risk reward forex is essential as it helps to set entry points, stop level forex, and take profit orders.

5. Manage Your Risk In Each Trade

As you learn risk management, your trading capital is of utmost importance and should be protected. It is logical to risk a small percentage of your trading capital.

As you learn risk management, your trading capital is of utmost importance and should be protected. It is logical to risk a small percentage of your trading capital.

Consistent forex traders often risk 2% or less of their trading capital per trade easily determined by the forex position size calculator.

For example, if your forex trading account has $20,000, then $400 is the maximum risk per trade. This forex risk management strategy protects your trading capital, especially in a series of losses as you incur smaller losses per trade.

Use stop loss to manage the forex dangers. Also, stop level forex helps to minimize losses, protect capital, and lock in profits.

Having learned how to manage forex risks in a trade, the next step is to …

6. Have Consistent Risks

Occasionally, luck may be on your side, leading to a series of wins. These wins might ignite your greed appetite, tempting you to increase your trade size.

Take precaution as the Forex market is highly volatile, and your account could easily be wiped out in case forex market trend reverses.

Control your greed emotions and be consistent in your risk per trade. Being overconfident and greedy just because of few wins leads to changes in forex risk management tactics.

And, to manage risks, control emotions and trade consistently, use …

7. Forex Trading Plan

Forex trading plans remove impulse trading associated with forex trading newbies. Having a trading plan with clearly defined goals is good, but it is even better to stick to it in all trades to manage forex risks.

The trading plans help in the forex control of emotions and prevent over-trading. It also instills discipline in trading, which is crucial for effective forex risk management.

8. Good Leverage For Forex

Leverage allows a trader to invest more money than their trading capital. The major reason being forex trading has high liquidity.

However, leverage should be used cautiously as it can easily cause massive losses as you expect big profits.

Forex leverage limits is best determined by forex leverage calculator based on margin trading, enabling forex traders to trade with borrowed money.

There is a high temptation to use high leverage to make bigger profits. Even the good leverage for forex, if not handled properly, can easily wipe an account in a single loss.

9. Forex Currency Correlations Are Important

Foreign exchange currencies are correlated as they are priced in pairs. Understanding the correlation is essential as it will help in reducing risks of foreign exchange investment portfolio.

Correlation is an indication of how one currency pair moves relative to another pair. Positively correlated pairs move in the same direction while negatively correlated pairs move in opposite directions.

Thus don’t open several positions that cancel out each other or positions with the same quote currency.

10. Be Realistic To Manage Forex Risk

New financial traders, while being very aggressive, often set unrealistic expectations hoping for quick profits. Setting realistic goals is the best approach to forex trading risk management.

Being realistic entails accepting the outcome of every trade calmly and moving on to the next one. You don’t have to be correct in every analysis.

11. Manage Forex Emotions

The best risk strategy in currency trading requires a proper mindset by having forex control of emotions arising from fear, greed, and winning excitement.

Why?

Because it is impossible to make rational decisions while highly emotional. Besides, it leads to changing forex trading plans and high risk forex trading.

The best forex risk management strategies start by managing stress in our lives.

12. Trade Journal

The best way to manage risk in forex trading is by keeping proper records of each trade, in a trade journal.

Periodically evaluate the data on the journal and the effectiveness of your trading plans.

Conclusion

These strategies will greatly help in forex risk management if used effectively.

However, it is crucial to test and practice any technique on a forex demo account as poor risk management will surely lead to losses.

A proper forex risk management chart minimizes losses and makes profits with minimal forex trading stresses.