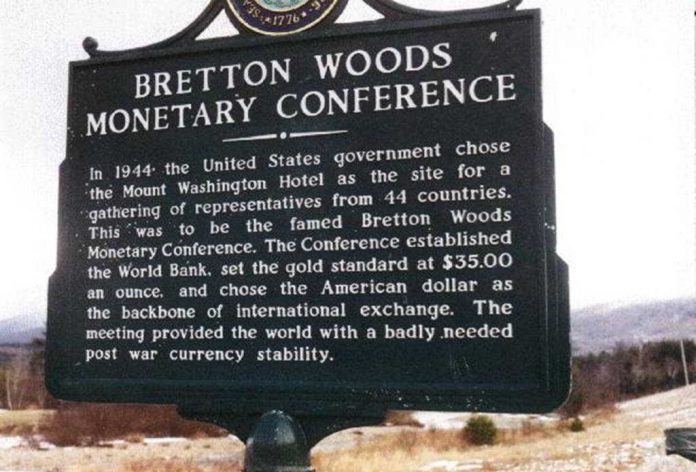

The History of Bretton Woods Agreement dates back in the year 1944 when it was formed. It was established by the global corporation and coordination, whose main aim was to determine how the monetary and exchange rates would be managed.

The treaty was sealed during a conference held at the UN Monetary and financial conference in New Hampshire. The accord pegged the currency and the cost of gold. In this instance, the US dollar was made the global currency.

This accord happens to be one of the most significant decisions that were put into action in the global’s financial account.

Objectives of the Bretton Woods Accord

The main aim of the Bretton Wood accord was to stabilize the exchange rate and at the same time promote peace worldwide through the coordination of the currencies.

This was realized during World War 1, where many countries were on the gold level. For the states to pay off their war costs, they had to print currencies to remain afloat. Hyperinflation at this time took preference making the supply of money high that what was required and as such, the agreement had to take effect.

On the same note, the global community had to step in and come up with a solution that would stabilize the currency and minimize any selfish policies that would have been adopted by some countries. That is how the objective was met considerably.

Key Features of the Bretton Woods Agreement

There were three main features in the Bretton Wood System, and these were;

There were three main features in the Bretton Wood System, and these were;

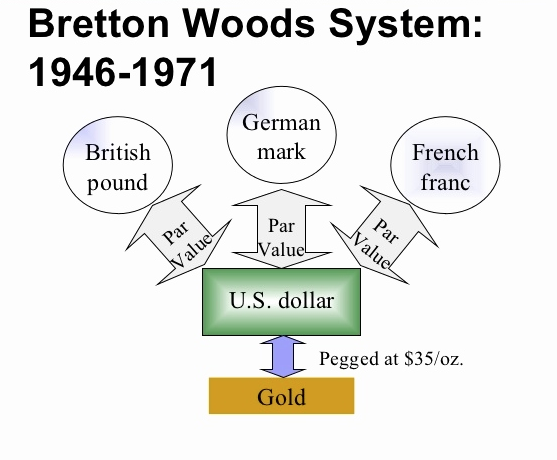

- It helped to manage the exchange rate to be pegged at 1% of the par value. The only time that the cost could be adjusted was when the IMF was in agreement of any adjustment.

- Offset any payment imbalances. The official reserves, in this case, could have in short term imbalance and in most cases, this took place where US dollar transactions were involved.

- Peg the value of the domestic currency, which was in terms of gold as at then to be evaluated in terms of US dollars.

- This was the base standard. For instance, each US dollar was pegged to gold at $35 for an ounce of gold. This was extended to other countries in terms of the $ US.

Discontinuation of Bretton Woods Accord

In the year 1968, the US dollar started to be overvalued. This went on until 1973 when the rise in the dollar raised anxieties to the global community regarding the exchange rate and the way the gold was pegged on. President Richard Nixon gave orders to suspend the conversion of the dollar which came in as a surprise. And this was termed as the Nixon Shock. The dollar was deflated to 1/38 of an ounce of gold at this time.

However, the intended plan backfired, and the US, gold reserves were redeemed at a higher rate than expected. Since there were no price controls, the gold price was on the rise in the free market and reached $120 per ounce, the Bretton Wood System could no longer be sustainable and came to a fall.