Fundamental analysis is economical, financial, and government information examined to decide how the currency price may move on any given day. In our review of the week ending 26th April, 2020 we shall focus on the major eight currencies – the USD and the G7 currencies

The Major currencies are:

- US dollar (USD)

- EURO (EUR)

- Japanese yen (JPY

- British pound (GBP)

- Switzer franc (CHF)

- Australian dollar (AUD)

- The Canadian dollar (CAD)

- Newzealand Dollar (NZD)

The G7 countries include many who use the Euro and are so named because they have a stable economy and financial situation compared to other nations. Most G7 currencies respond to the US economic data and the news, both good and bad, around the world.

COVID 19

The cascading effect of the Global Coronavirus pandemic continues to ravage the world economies in all countries negatively. As per the update on 26th April coronavirus world statistics: confirmed cases 2,966,489, deaths 205,928 and recovered 873,857.

The lockdown responses and policies in nearly all countries and negatively impact all sectors of the economies. The reactions towards curtailing the spread of the virus have led to the loss of jobs, fall in business activities. Slowed production and service sector and hence badly effect the G7 currencies

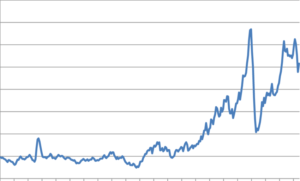

Change in Oil prices

For the first time in history, oil prices on Monday went negative. Demand for the energy driving commodity dwindled as supply continues to rise. Oil storage by operators spaces running out and the cost of storage being high also make the efforts to fight the COVID 19 have resulted the near evaporation of global energy demand. At the same time, there is an oversupply of oil. Hence change in oil prices effect the G7 currencies

European Union

Amid the continued struggle against COVID 19, the European Union leaders could not even agree on the provision of comprehensive economic relief funds. This bad European Union news negatively affected the Euro currency over the week. The leaders agreed to set up but fall short on the financing and amount required.

Other news

- The clinical test on the much await vaccine against coronavirus fails in trials

Major currencies overview

The US dollar (USD)

The US dollar currency was stable compared to all other G7 currencies. Over the week, It fluctuated within a narrow against the Japanese yen (jpy) but gained sharply against the Canadian dollar, Euro and sterling pound.

Data on the US dollar index suggests that the dollar traded within a narrow range at an average of 100.41 over the week. The lowest point was at 100.25, while the highest being 100.87.

The news affecting the dollar

The coronavirus vaccine trial failure amid high expectations. The much-awaited first randomized clinical trials of remdesvir antiviral drug by Gilead sciences failed. The company was testing the effectiveness of the remdesvir antiviral drug in treating COVID 19 was undergoing testing by the Science company of the USA. The failed trial caused investors to be jittery. However, the dollar responded slightly over the failure.

The other bad news against the dollar was the Job losses in the USA. In response to the bad press, the government passed an Economic stimulus package to offer a paycheck protection program for small companies

EUR/USD negative in the week ended

Euro fell by o.4 %

The Euro started the week on the wrong side, and it continued on the downward trend over the week. However, it nearly stabilized at 1.08 on Friday but shifted back on the downward trend closing the week at 1.0824, having started at 1.0863 on Monday. The ECB has scheduled a meeting to address the weakening Euro against the dollar, which they are the real cause.

The news affecting the Euro

The European Council failure to reach an explicit agreement on the comprehensive economic relief package. Europe also continues to struggle under the effect of widespread coronavirus lockdowns, which has affected the economies of if its member countries. Negative news and economic data from Germany, Italy, and Spain worked against the Euro.

A negative week for GBP/USD

The sterling weakened significantly against the dollar. It started the week at Start 1.2437 to close lower at 1.2366, indicating that the sterling as the biggest loser of the week. The British have been Under lockdown for longer than the USA.

The negative sentiments hurting the pound include:

- Boris Johnson failure to attend coronavirus meeting

- Brexit situation

- Coronavirus affecting its production and service sector.

- The USA economic stimulus in corona relief

- Negative economic data released

- Changes in oil prices

Stable USD/JPY

This pair currency mostly traded below 80 pips but was generally stable.

On Monday, it opened at 107.63 to close at 107.57 on Sunday. This pair Showed no significant difference as both currencies are in very high demand amid the coronavirus threat.

The dollar and the Yen are safe-haven currencies during weakening economies. There were no significant economic reports from Japan that could affect the Yen. On a positive note, japan announced stimulus funds to support its economies against the threat of COVID 19.

AUD/USD steady gain

The Austrian dollar started the week at Start 0.6337 gaining steadily to close at 0.6389.

In the first two days, AUD declined, but regained and rose from Wednesday and continued to advance steadily against the USD throughout the week to close on positive territory. The bouncing back of the Australian dollar is attributed to the bouncing back of oil prices.

Australia’s strong fight against coronavirus helped its dollar to improve against the USD. Overall, Australia hard positive economic data that supported its currency. Australia started earlier fighting the coronavirus and have stated easing of the lockdown earlier than other countries.

NZD/USD losing

On Monday, NZD/USD stated on a downward trend. However, it recovered from Thursday with the bouncing back of oil prices. Newzealand released a series of negative economic data that led to the fall of its currency against the USD.

The coronavirus also obviously pushed NZD to the reds against the USD. This currency pair was affected by

- US economic stimulus package

- Coronavirus

- Negative economic data

USD/CHF

This currency pair was also primarily affected by global economic sentiments.

Negative economic data, US economic stimulus, coronavirus, and crushing oil prices affected the swiss franc.

It starts the week at 0.9679 and closed at 0.9737

Conclusion

The volatile forex market for the week ended was primarily affected by global sentiments amid the persistent thread of coronavirus and depressed world economies. The safe-haven currencies we’re stable while commodity currencies fluctuated in response to oil price changes and negative economic data.