Here’s the thing about leverage and margin; margin is used to give you leverage.

What is Leverage in Forex Trading?

Leverage essentially refers to an increased trading power conferred upon people who use margin accounts.

The mainstream definition of leverage in forex is a trader’s ability to control a huge chunk of money with very little or no money of your own while borrowing the rest.

Through leverage, one may take a trading position that’s larger than the amount of cash they’ve deposited in their trading account.

Why Do Brokers Offer Leverage?

Brokers offer leverage and margin as an opportunity for traders to finance large trades by investing only a small part of their money.

This is beneficial because not many individuals would, for instance, be enthusiastic about buying a standard lot of currency at $100,000 the very first time, they begin trading forex. It’s also common knowledge that not everyone possesses a large amount of money needed to trade a standard lot.

Additionally, leverage is a springboard which if used wisely can allow a trader to make profits faster and in huge amounts as we shall be seeing later in this article.

How Leverage Works in Forex

Leverage is usually a ratio between what you have in your account and the amount of cash that you can trade.

It will typically appear in an X:1 format.

For example, if your forex trade account offers you a 100:1 Leverage, you can trade currency worth 100 times more than the amount in your account.

Say you want to transact a $100,000 position through leveraged trading at 100:1; your broker sets aside $1,000 from the capital in your account and allows you to control the $100,000 trade as you wish.

Benefits of Using Leverage

Now, let’s say the $100,000 investment grows to $101,000 and you close the trade. The profit gained is $1,000.

Remember that your broker merely set aside $1,000 for this trade—and you made $1,000 in profit. This is a 100% profit!

Now, let’s consider what might have happened if didn’t use leverage and instead, you traded with your own money.

So, you traded $100,000 and it grew to $101,000 giving you $1,000 profit. This is a mere 1% profit!

Leverage Is A Double-Edged Sword

Different providers offer different levels of leverage and margin —and we’ll show you what this means to a trader.

Let’s assume that trader A’s account has a 50:1 leverage while trader B’s account has a 5:1 leverage. Both have $10,000 in their accounts.

What happens if both trade on leverage and experience a 100-pip loss?

| Trader A | Trader B | |

| Trading Capital | $10,000 | $10,000 |

| Leverage | 50:1 | 5:1 |

| Total Value Traded | $500,000 | $50,000 |

| loss in dollars (100 pip) | $5,000 | $500 |

| % of Capital lost | 50% | 5% |

| Trading capital left in the account | $5,000 | $9,500 |

As you can see, the higher the leverage used, the higher the risk of loss.

What’s a Forex Margin?

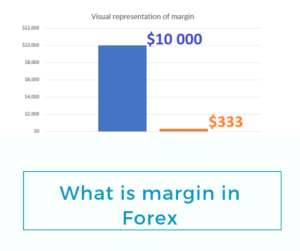

Remember how in our earlier example, your broker set aside $1,000 to allow you to control the $100,000 position? Well, the $1,000 that was set aside is referred to as a margin.

Margin is essentially a good faith deposit i.e., a certain amount of money needed to open a position with your broker.

Margin isn’t a transaction cost and neither will it be charged to your account. It’s merely collateral that your broker holds relative to your trade position size.

Your broker uses the forex margin to maintain the positions you open. Think of it like this; your broker takes that margin, pools it with other margins from other traders, and generates one “super margin deposit” which the broker then uses to place trades in the interbank network.

How Margin Works in Forex

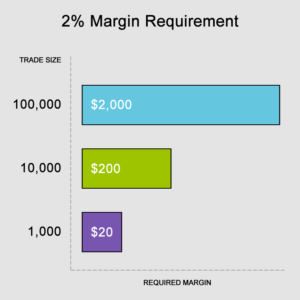

Margin is usually a percentage of the full trade position and is expressed as so. A broker may, for instance, say that they require a .5%, 1%, 2% or even 5% margin

Once you know how much margin is required by your broker, you can then work out the maximum leverage you can get from that broker.

For instance, if a broker’s margin requirement is 2%, then, they provide a 50:1 leverage

| Examples of common margin requirements and their corresponding leverages | |

| Margin Requirement | Leverage offered |

| 0.25% | 400:1 |

| 0.50% | 200:1 |

| 1.00% | 100:1 |

| 2.00% | 50:1 |

| 3.00% | 33:1 |

| 5.00% | 20:1 |

Other Types of Margin

Besides the margin requirement, there are other types of margin that you will encounter in the course of your trading. Here are some of the commonest margin terms in the financial markets:

- Margin requirement: you already know this one. We’ve just said that it’s the amount of money the broker needs from you to open a position. It’s usually expressed as a percentage.

- Used margin: this is money that is locked up in the trades that you have opened. Technically, this money still belongs to you. However, your broker has locked it up and will give it back after you successfully close your trades or if you get a margin call.

- Margin call: Margin call happens when a trader’s equity falls lower than their used margin. This means that the money in their trading account isn’t enough to cover their trade losses. Note that when you receive a margin call, the broker will forcibly close some or all of your trades at market price.

Securities Margin Vs Forex Margin

Sometimes, some people refer to the margin in forex trading accounts as a performance bond. They call it that because a forex margin isn’t borrowed money.

Sometimes, some people refer to the margin in forex trading accounts as a performance bond. They call it that because a forex margin isn’t borrowed money.

For example, if trade $100,000 worth of currency by depositing $1,000, you aren’t actually borrowing the other $99,000—and you don’t even have to pay interest for using that leverage. The $1,000 margin is merely money that’s needed to make sure that the trader can cover his or her losses.

In trading securities, however, the margin is money borrowed as a partial down payment for buying and owning a stock, bond or ETF. The margin can be up to 50% of that instrument’s purchase price.

Traders who use margin in securities trading are said to buy on margin.

So, when a stock trader borrows the margin from their stockbroker to buy stock, they are taking a loan from their brokerage firm.

A forex trader, on the other hand, deposits the margin into their account and the broker sets it aside to open a trade position. They are essentially placing a good faith deposit.

Conclusion

As we’ve seen, leverage and margin trading increases the potential returns on your investments. However, at the same time, your potential losses go up as well.

Therefore, you have to think carefully about how much leverage and margin you want to take up.