Forex traders should be aware of the various costs involved in different trades when drafting a trading strategy. Such costs include forex rollover interest rates for selling or buying available foreign exchange currencies, applicable overnight.

Forex traders should be aware of the various costs involved in different trades when drafting a trading strategy. Such costs include forex rollover interest rates for selling or buying available foreign exchange currencies, applicable overnight.

The rollover buy or sell has a great impact on the trading strategy adopted by a trader. Learn, in this article, what is forex rollover and how it works in forex market?

What Is A Forex Rollover?

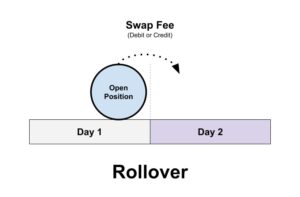

Rollover is a way of prolonging the settlement date of an open position. By rolling over a trader virtually extends the settlement duration of a transaction by another day.

Rollover is a way of prolonging the settlement date of an open position. By rolling over a trader virtually extends the settlement duration of a transaction by another day.

Each fx currency attracts interbank interest rates charged for keeping a position after the settlement period, in most cases, after 5:00 pm Eastern Time (ET).

Therefore forex rollover or forex swap is the interest received or paid by a forex trader to keep the fx currency position overnight. It can either be a rollover debit (negative) or a rollover credit (positive), charged on the duration of days held.

As each forex trade involves paired currencies, each trade must, therefore, have varying interest charges. Interest is charged or earned on each open position held overnight, depending on the differences between the currency’s interest rates.

It is the difference in interest rates that attract forex rollover rates or swap fees. Moreover, multiple rollover days are applicable on various trading days like Wednesday or during certain national holidays for the currencies tied in a pair.

These national holidays fall on that day or the following day. In foreign exchange currency pairs, the first one is the base currency, while the second is known as the counter currency.

Differences in the base and counter currency interest rates account for the rollover cost. After understanding forex rollover meaning, the next question is, how does it works in forex market?

How Does Forex Rollover Works In Forex Market?

An open forex trade position will either pay or earn the difference in rollover interest rates of the foreign currency pair held overnight.

The rollover interest rates or forex swap fees indicate commissions or fees on an fx currency held by the trader after the trading day.

By deferring the settlement date, the trader essentially closes an open position at the day’ closing interest rates.

And he or she will then re-enter the trade at a new opening rate on the following day. If you don’t want or need to incur rollover cost, then you close all open positions before the trading day ends.

The terms rollover and swaps are used interchangeably. However, the swap is mostly used in MT4 trading platforms, while rollover is typical in the financial industry.

Rollover Debit & Credit

Rollover credit occurs when interest rates of a long currency are higher than that of a short currency. Similarly, rollover debit results if the long currency’s overnight cost is lesser than that of a short currency.

Thus, in the rollover credit, a trader receives the interest, but in the rollover debit, the trader pays the interest. The rollover credit is advantageous to forex traders because many would rather profit from forex trading than keep the delivery.

Forex Rollover Calculation

Nowadays, Calculating rollover interest rates in forex is simplified by the aid of a rollover interest calculator available online.

Alternatively, you can easily inquire about rollover commission at the rollover counter in your bank. However, you can avoid unnecessary calculations and quickly get swap fee at the forex trading platform or the broker‘s websites.

The manual calculation of rollover cost is not complicated either, and you can easily do it on your own using a calculator while applying the formula below.

Forex rollover fees = position size X (counterparty fee X pip value)/currency rate.

If you intend to hold trades overnight, it is essential to put rollover dates under consideration.

This is because of the multiple rollover days – applicable in multiple trading days like Wednesday or during certain national holidays for the currencies tied in a pair. These national holidays fall on that day or the following day.

Whereas the forex swap fee is stable under normal situations, increased credit risk puts pressure on interbank rates directly affecting rollover forex swap on different days.

Forex rollover commissions are valid only after day trades. In essence, avoid negative rollover by closing all open positions before 5:00 pm Eastern Time.

Booking Rollover

Business day closing time is of the essence as you consider to book a currency rollover.

5:00 pm ET is the critical time for booking rollover in forex trading. All positions opened before 5:00 pm will be subjected to forex rollover cost on the same day at 5:00 pm.

On the other hand, all positions opened after 5:00 pm will be subjected to swab fee the following day at 5:00 pm.

Forex Rollover On Weekends

In forex trading, rollover on foreign exchange currencies is calculated between Monday and Friday. But, what about on weekends as there are no rollovers on these days?

Most banks are closed on Saturday and Sunday; hence rollover is not applicable on these two days. However, the banks will still charge rollover commission on these two days.

How? Banks usually account for these days by booking three days applicable for overnight costs on Wednesday.

What About Forex Rollover On Holidays?

A good question, but an easy one at that. Holidays have no rollover interest rates. However, the banks book an extra day to charge rollover fees two working days prior to the holiday.

Usually, a holiday rollover happens if one of the currency pairs is due for a major holiday.

A good example is July 4th in America- independence day in the US. For all American banks, an additional day of rollover is applied to all USD currency pairs on July 1st at 5:00 pm.

Benefitting From Forex Rollover

If you plan very well, you can reap from a rollover in forex trading. The goal of every financial trading is to make a kill.

As you plan to take advantage of rollover interest rates in your trading strategy, here are great tips to aid you:

- If you suspect that the rollover rate is likely to be negative, kindly close all open positions before 5:00 pm ET. This move is suitable when dealing with emerging markets fx currencies or cross pairs currencies. You may also close the open position if it has been profitable, and you don’t believe that it is going to gain anymore. Besides, it is logical to close nonprofitable positions, especially those trades that you think will not turn around.

- When you suspect that the forex rollover is likely to be positive and you prefer to go on with the trade, it is okay to leave the positions open. Consistent forex traders will prefer to keep profitable positions running for more profits and leave it for a rollover.

- And most importantly, always keep track of the Calendar of the Central Bank. This will help you keep track of the possibility of forex rollover drastically fluctuating.

Conclusion

Rollover has both positive and negative impacts. Understanding the concept of forex rollover and how it works will help you strategies effectively your trades.

Take advantage of a rollover to make money by implementing the tips provided in this article.