Forex market happens to be one of the largest markets in the world. The market trades on billions of dollars in a day. As a result, several players in the market are worth knowing about. The major players in the forex market have a significant impact on how everything goes on. If you want to be a good and successful trader, then you need to know the players in the market. This helps you to understand how they work and how they can affect your trading.

Major Players in Forex Market

Understanding these players is essential to help you know about their contribution to the market.

-

Commercial Banks

Commercial banks play a big part in the forex market. Commercial banks all over the world have a task to engage in foreign currency exchange. The banks need to exchange foreign currencies on behalf of their customers as a result of the interbank market where they are dealing with clients with different currency requirements. As a result, they continuously exchange currency hence participating in the forex market. Since there is a need for currency transfer between commercial banks, they do not have to do it manually but instead through electronic trading channels.

Other than engaging in the forex market for the needs of their customers, commercial banks also speculate forex trades to help them a profit when making forex exchange.

-

Highly Wealthy Individuals

High net individuals are considered as major forex trading specialist in the forex market. High net individuals refer to people who have investable assets of $1 million and above. Such individuals might not trade directly but play a huge role. They trade through investment and commercial banks. High-net individuals have a lot of investable assets that impact the forex market in a big way. Many high net individuals across the world play a vital role in the forex market.

-

Central Banks

Central banks play a huge role in the forex market. They are the major stakeholders in the market. Central banks impact the forex market by fixing currency rates. It is because the central banks are responsible for their countries currency value. As a result, they work to stabilize the countries economy by stabilizing the currency. One way they do this is by influencing the value of the local currencies through interest rates. What happens is that there is a distribution in a change to other factors, including forex trading. Another way the central banks contribute to the forex market is by making huge sales or purchase of forex. It is a move that is done to stabilize its country’s economy by boosting the value of their local currency.

-

Hedge Funds

Hedge funds are the second largest plays in the forex market after the banks. Managers of hedge funds speculate the forex market to make huge profits out of the massive capital in their disposal. The main reason for contributing to this is due to their vast pool of investment at their disposal, which is in terms of millions of dollars. As a result of this, many such parties cause a significant effect on the forex market. Such institutional investors contribute to up to 30% of all transactions on the forex market.

-

Individual traders

Individual traders do not contribute so much in the forex market as compared to other, more prominent players such as corporations and banks. However, irrespective of having small percentage contribution they still have an impact on the market. Millions make individual traders of people across the world who do speculations on forex trades with to make a profit. Most of these people do not have a lot of capital to trade on in the market.

-

Corporations

Corporations work at international levels, and as a result, they deal with a lot of foreign currency. Firms have to make the foreign currency exchange for them to be able to trade. Due to their regular trading with other foreign countries, any fluctuations in the forex market pose a significant effect on the operations of corporations. Corporations deal with huge amounts of money, and as a result, they participate in speculating trends in the forex market. Being able to speculate performance in the exchange rates gives these companies advantage when exchanging currency from another country for trading purposes.

Categories of Major Players in Forex Market

The major forex market players can easily be categorized based on their contribution to the market and how they work. These categories have groups of players and how they participate. Such categories include.

Interbank Currency Market Players

It is a group that involves players that participate in the forex market as a result of them handling currency, primarily through interbank transactions. Players in this group make a lot of bank to bank transactions and at massive amounts, which make them essential in the market. These members include;

- Interbank Market Makers – It is a group made up of investment and commercial banks. They make foreign exchange quotes on the market; hence, they are called the market makers. They also have large clients whose contribution is significant.

- Central Banks

- Interbank Forex Brokers – It refers to brokers who work with interbank market makers. There work to work as intermediaries between interbank market makers by arranging forex deals.

- Interbank Electronic Forex Brokers – It refers to electronic platforms that are used for forex transactions. They include the Thomson Reuters Dealing service and the Electronic Broking Services.

- Hedge Funds

- Multinational Corporations

- Small Financial Institutions – It is made up of those small banks that may participate in forex exchange on their own mostly on behalf of their clients.

- Individuals with high net worth.

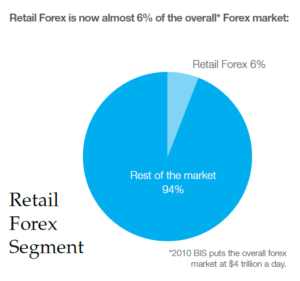

The Retail Forex Market

The retail forex market is considerably big, as very many people make it. Such people include travelers, tourists, or students that have to travel to foreign countries. As a result, when they exchange currency, they impact the forex exchange market in one way or the other. Although they deal with considerably small amounts of money, they still affect the market. However, it is essential to note that most of the retailers do their forex exchange online through online brokers. They still contribute to the market.

Participants of the retail forex market

The main participants of the retail forex market include;

-

Introducing brokers- Introducing brokers are private forex agents who work by introducing new customers to a forex broker. Their main work is to get potential forex market customers and to lead them to the big brokers. As a result, they receive a commission.

-

Online Forex Brokers- The online forex brokers make one of the biggest group of brokers that have been in this market for a long time. Their contribution is significant since they help many people, especially individuals trading with low amounts of money to have access to the market.

-

Retail Forex Traders-This is a huge group that is made up of both traders and speculators. In this category, there are both small to large traders in the market. One common thing about traders in this group is that they bank on short-term changes in currency pairs.

Forex Future Market

Exchange-traded futures are traded through the IMM. The forex futures market has been there for a long time and based on futures contacts. Apart from currency futures being done through the International Monetary Market, they are in terms of US Dollars. However, they can be in other currencies when dealing with different countries.

Participants of the forex futures market

The main participants of the forex futures market include the following:

-

Specialist Market Makers–This refers to traders whose main job is to offer liquidity to financial institutions and other traders in the forex market. Specialist market makers work hand in hand with financial institutions and other significant traders. There work to offset forex positions and as a result, offering other traders liquidity after trades take place using a futures position.

-

The Chicago IMM Futures Exchange –It results from a merger between the Chicago Mercantile Exchange and International Monetary Market. It has been operating on forex futures for several years.

-

Commercial Traders –This refers to traders working in foreign exchange departments on behalf of large corporations and other big companies. Their main work is to convert foreign currency on behalf of the company oversees. As a result, they can participate in forex futures contracts.

-

Algorithmic Traders and Arbitrageurs–It refers to a trader who creates electronic systems for trading. Such systems can effectively execute trades on either buy or sell by utilizing any favorable arbitrage opportunities. The systems are very fast, such that they can execute large transactions quickly and automatically making use of programmed algorithms. The algorithms can automatically identify and close any gaps upon profits between spot forex and futures markets.

-

Non-Commercial Traders –Non-commercial traders can participate in forex futures. Some very many individuals trade in forex futures. Irrespective that they do not spend a lot of money on this, they can take futures contract just like spot market. Once they have a contract, they can gain delivery from the seller once maturity time is reached.