Financial trading in the forex market involves undertaking risks. However, understanding trading psychology will cushion you against unnecessary risks associated with emotion trading. Emotion trading causes emotional stresses and financial losses. Avoiding such miseries and losses requires confidence and trading without fear.

Psychology Definition

The psychology definition is the state of your mind and emotions that affect your behaviors. Trading psychology is exercising emotional discipline by avoiding emotions drive decisions.

You are the person behind the trades, and your emotional and psychological stability is vital in determining your trading behaviour.

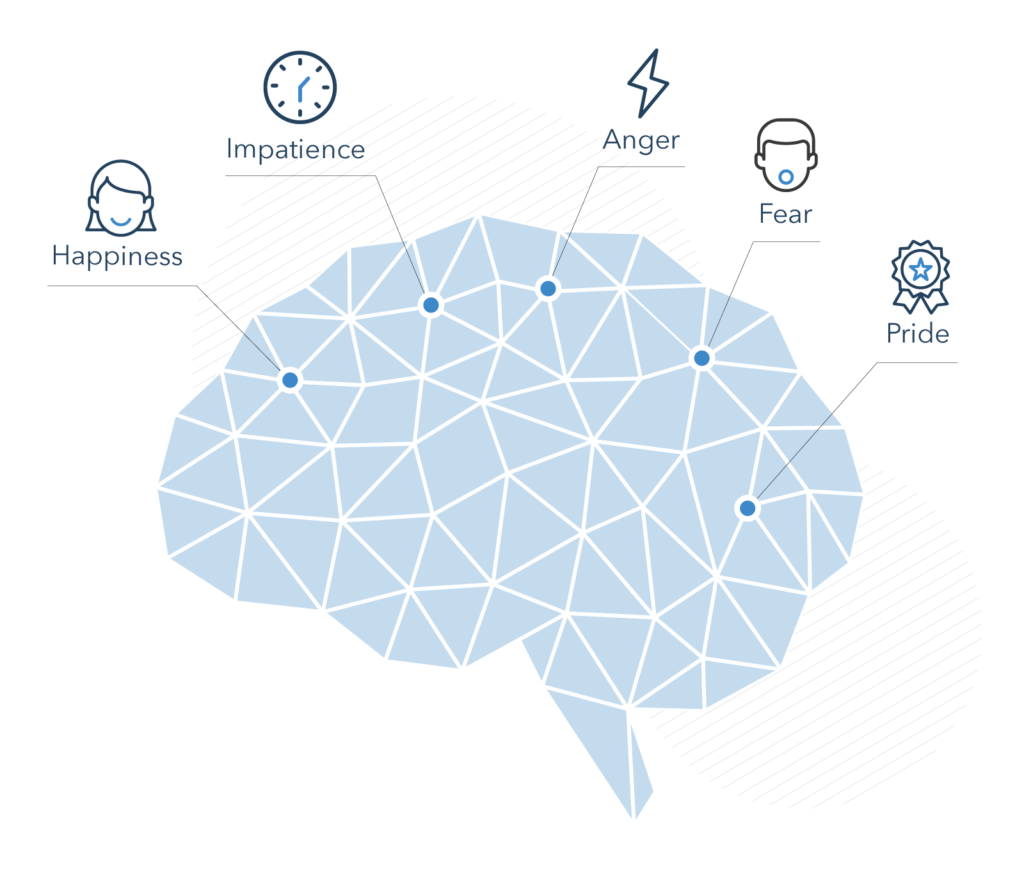

Emotions in psychology

Now let us learn techniques to control your emotions in trading psychology, and the psychology of trading as outlined below:

Figure Out What You Are Feeling

When you are enduring a surge of negative emotions, take a time out and ask yourself what you are feeling right now.

Is it anger that you feel? Or is your anger a mask to hide something else?

You Are the Master

You do not serve your emotions. Your emotions serve you.

Taking the time to understand trading psychology helps you master your emotions and prevent frequent mistakes.

As you learn to discipline your feelings, focus on these questions.

- What can I learn from my emotions in psychology?

- Why did I react that way?

- How would I like to feel?

- What should I focus on to be in a state where I am the master of my emotions?

- What steps can I take now?

Importance of psychology

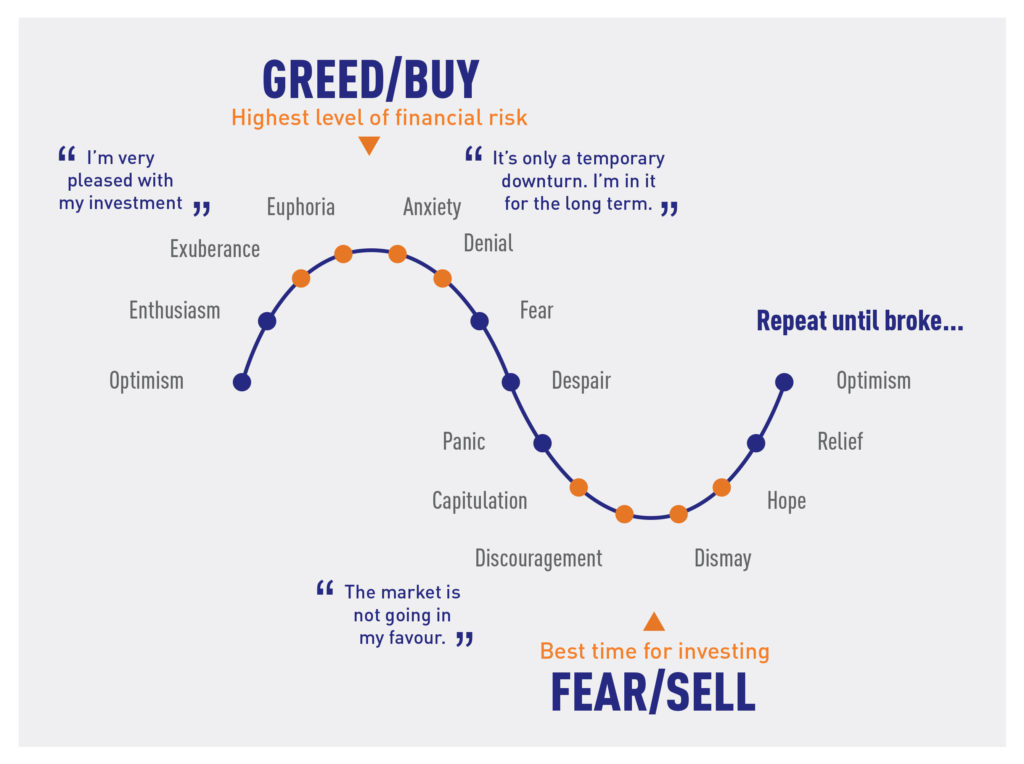

Emotions cause misjudgments leading to losses hence learn to discipline your emotions. If the trade is benefiting you, do not react too positively. Resist the temptation of taking bigger risks just because you are having a spell of good fortune.

In a lousy trade, do not panic but learn from the mistakes. Start by taking some time out to focus on your emotions and to deal with trading psychology.

It is difficult to split your mind between the trades and your present frame of mind. Stay focussed and objective in times of uncertainties as you try to understand the psychology of forex trading.

The psychology of forex trading

Let us talk about forex trading psychology:

We just stepped into the emotions drive decisions in the world of trading psychology.

Overcoming Fear

Negative news about a specific trade in the forex market cause worries. Beginners overreact, cut short losses,and exit the market. Even though they minimize losses, they miss the opportunity for some gains.

Fear is a natural response to a threat—in this case, to your losses or the potential to make more money. Reflect on what causes the fear in you and ways to remove the negative feeling.

By contemplating the problem of emotional discipline ahead of time and understanding how you may unconsciously respond to or recognize certain things (for example, how do you react to dips in the currency value), you can hope to separate and identify those feelings during a trade. When you can identify the emotions, you can easily counter them.

You can attempt to use your efforts to move past the emotional situation you are facing. A trading journal is a must to alleviate negative trading psychology, such as fear, greed, and hesitancy.

As with all emotions, this ability to learn about your fear is difficult. It may take practice, but it is necessary for your psychological stability. Overcoming fear will help you to control forex trading profits emotions

Overcoming Greed

“Pigs get slaughtered” prominently useful phrase in Wall Street. What does this mean in trading psychology? This saying mentions greedy traders holding on to winning trade for too long, hoping to get every last benefit they can get out of it.

Greediness is reflected in forex trading profits emotions as profits increases. The inability to accurately predict where the market is going can sometimes mean that the value of your trade can take a sudden nosedive.

That means everything you have achieved so far does not matter.

You have lost it all.

Unfortunately, greed is hard to leave. Greediness is dependent on the instinct to keep going to try to gain just a little more.

Do not let greed overwhelm you. You should learn to recognize your impulses and develop a trading behavior that has rational decisions as to its foundation.

Your instincts cannot dictate the way the market goes. Your keen knowledge, attention, and experience can.

Establish Rules

Trade intelligently following rules and guidelines based on trading psychology, and your tolerance to handle risk and reward. Identify your entry and exit points in a trade through deep trend analysis.

Check out our weekly fundamental analysis Here

Adopt the best stop loss strategy in forex trade. Consider establishing certain limits on the amount you are willing to win or lose every day.

If you can reach a profit target, then take the money and leave. If you are missing on your trades and your losses reach your predetermined limit, then stop and cut short your loss.

You can always study forex market psychology and have another trade, but you can never return from massive losses. You might find yourself in a terrible situation that might affect your life and your future.

Do not go there. Make sure you are careful and thoughtful about the psychology of trading.

Research

Your trading should be based on market research and proper trading psychology. Read about forex market psychology and attend trade seminars and conferences.

Additionally, set aside a time every day to know more about global events, currency fluctuations, economic and political conditions, and every other factor that could affect your trade.

You should also devote time to study charts, communicate with other traders, or even read trade magazines and publications.

Trading without fear is achieved through research, trading strategy, and understanding forex trading psychology.

Conclusion

Your mindset is of the utmost importance in forex trading success.

With the right mind frame, you will incur minimum losses, achieve better gains, and, most important of all, a peaceful mind.

To succeed, you need to learn to discipline your emotions and treat forex trade as a business with losses or profits.