Slippage is a word that you will often hear if you are a forex trader. Moreover, the concept of slippage in forex trading is poorly understood by many traders.

The forex traders will benefit significantly by understanding the problem and how to avoid its pitfalls. This article intends to shed more light on this concept and forex slippage control.

What Is Slippage?

As you endeavour to be a consistent trader, it is essential to understand – what is slippage and how to avoid slippage in forex trading.

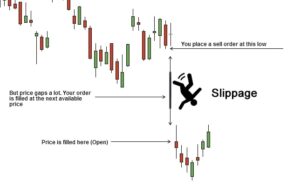

You may place a trade order to buy or sell a currency pair or set a stop-loss order at a specific price. However, the trade or stop loss order gets executed at a slightly different price resulting in slippage.

Slippage definition is the difference in price between at which an order is placed and gets settled.

Why?

Having looked at slippage meaning in forex, you are probably wondering why slippage occurs in forex? Slippage always occurs during high market volatility, probably reacting to forex news events.

Trading within forex peak market hours that coincide with vast volumes of trade in foreign currency pairs also leads to slippage.

How?

Trade orders are ideally executed at a favourable market rate. Depending on the order execution, the realized rate could be more desirable, same as, or less desirable than the placed rate.

This difference in order execution price and placed order is categorized into;

- Positive slippage: ask price decreases in a long trade or bid price increases in a short trade.

- No slippage

- Negative slippage: the ask price increases in a long trade or bid price decreases in a short trade.

Slippage is common, but more so during high volatility while using market orders. Also, market slippage happens when a big order is executed but cannot be fulfilled due to a lack of enough quantity to sustain the order placed.

Furthermore, slippage occurs when a stop-loss order is positioned lower than what was set in the initial order. If slippage occurs, forex brokers will mostly execute the order at the best currency price.

However, this is not always the case where a limit order is already in place. Slippage trading has some impacts on forex trading, outlined next.

Impacts Of Slippage In Forex Trading

Slippage in forex may appear negative; however, this common forex occurrence could be a blessing in disguise. Forex market trading orders are executed at best, whether more favourable, equal or less favourable.

For more clarity on slippage definition, let look at the example below:

You intend to purchase the EUR/USD currency pair at the prevailing market price of 1.3670. However, due to the slippage factor, the order might get executed at 1.3660 at a more favourable rate.

In a less desirable rate, it could be executed higher at 1.3680. No slippage is another outcome, and your order gets settled at 1.3670, precisely as you placed.

When you trade at a favourable rate, you make gains, but when your order is executed at a less desirable price, you lose.

Anytime your order is executed at a different rate, know it is due to the slippage factor. While the slippage definition is quite simple and easy to understand the likelihood of it happening is unpredictable.

The changes in pips could be minimal, and thus the effect of the slippage could appear to be insignificant in smaller trades. However, the real impact is felt when dealing with large volumes.

Don’t panic as there are forex slippage control ways to protect yourself from slippage trading impacts.

How To Stop Slippage In Forex

Quick changes in forex market prices can cause market slippage to happen to result in a lapse between when a trade order was placed and its execution.

Since slippage happens in microseconds, there is no possible way to know beforehand when it’s likely to occur.

The following are the best ways to help you in forex slippage control:

Use Limit Orders

Slippage trading occurs mostly when forex traders use market order for entry or exit positions. Thus it is logical to use limit orders among other ways to stop slippage in forex trading.

A limit order is effective because it executes your trade orders at your intended price or more favourable market value. In sharp contrast, market order executes trade orders even at a worse price resulting in market slippage.

The negative slippage is best prevented by using a limit order. While it is the most effective way to prevent negative slippage, it has a limitation.

The limit order may fail to execute when the bid/ask price fails to return to the limit level. This limitation often occurs in a volatile market where prices fluctuate rapidly to prevent order execution at the quoted price.

Don’t Trade Around Major Economic News Events

Major economic news events always heighten market volatility that causes slippage trading. Therefore it’s beneficial to keep track of major events on the economic calendar in relation to the currency pair of your interest.

And if you are day trading, it is best to avoid trading during major financial announcements and news. Depending on the market reaction to the announcements, you could be vulnerable to the forex market slippage at that period.

Even though the economic news events may be tempting, the market volatility often hampers the execution of trade orders at quoted prices.

Major economic news events also impact trades orders placed prior to the announcement. This situation leads to slippage forex specifically on the stop loss.

Good Forex Broker

In addition to the above ways, choose a low slippage forex broker that also operates on faster execution speed platforms. The rapid speed would reduce order and execution time differences that lead to slippage.

The market maker brokers are known to manipulate market prices, exposing you to market slippage. To avoid the problem of slippage trading, chooses a reputable low slippage forex broker.

Main Key Points:

- Slippage is a price change between the trader’s order and execution, which can be negative or positive.

- How to avoid slippage in trading is best solved by using limit orders and avoiding market orders while using faster execution speed forex platforms.

- Furthermore, make use of the economic calendar and avoid forex trading in times around major economic news events. Placing orders at such times will subject you to significant slippage.

- Day traders are better off not trading around the major economic announcement.

The Bottom Line

The bottom line is to use slippage financial trading to your advantage with a reputable broker.

Taking advantage of forex slippage helps to reduce negative slippage while profiting on the positive slippage.