Forex Orders Types

Before understanding the forex orders types it is necessary to know that entering the forex trade is about making sure that the market is moving in the right direction for your trading strategy to work effectively.

Besides, the forex market is very volatile, thus requiring forex orders to protect your money, minimize losses, maximize gains, and for your mental health.

There are different forex order types you can use.

Market orders defined

How are market orders defined in forex trading? It is the oldest form of forex trading and usually the first one to encounter as you enter the forex market.

Market order has the sell and buys features only. Market orders are typically entered and executed at the forex market. The day traders and scalpers prefer these forex orders.

Stop-loss order forex

This is the most common type of forex orders that protects your position. After you enter the market, you need to set a type of stop loss.

The simple stop loss is set at a price point, such as 1.0456, and it will not move. If the currency rate hits 1.0456, your position is closed.

If it skips over that and goes below 1.0456, you are guaranteed a close at 1.0456 with most dealers.

Trailing stop-loss orders

These forex orders have stop-loss order forex, which follows the price increase by a set pip differential. If you enter at 1.0456 and set a trailing stop loss 20 pips off the price, you will follow the currency rate as it increases.

If the price goes to 1.0476, your trailing stop loss rises to 10.0456. If the rate turns around and goes below the last point of the trailing stop loss, the position closes, and you keep the profit at the 20 pips price or whatever the difference is between the open price and where you set the trailing stop loss.

Taking Profit

Taking profit forex orders allows you to keep your capital in play. The order is still open; however, you remove the profit you have made thus far during the trade.

For example, if you earned 100 pips, you can close out a part of your trade to remove the $100 you made on the 10,000 lot size. The capital remains in until another order is activated, such as stop-loss or you close the position.

Entry order

These are forex orders to enter a market or pull off the market. The order is set to either to buy below or sell above the market price.

Pending order forex

These are forex orders, or instructions send to a broker to be executed in the future once a specific price limit is reached.

Pending forex orders are advantageous because they are executed automatically; hence you don’t have to sit in front of a computer to monitor the market. Pending order Forex are grouped into two.

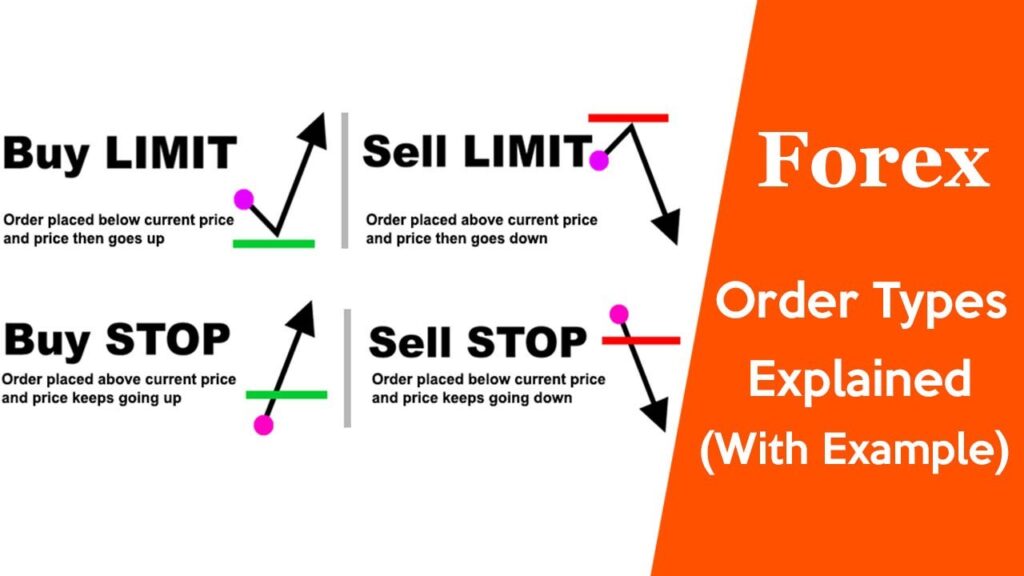

A. Stop Limit order

These are orders set at a better price than the current price

Buy limit order forex

How are forex limit orders explained? These are instructions send to a broker by an investor to purchase a currency pair at a lower price level allowing you to enter a market at a better price than the current market price.

For example, if the Eur/USD currency pair is 1.300, then you can set a buy limit at 1.200.

Sell limit order in the forex

what is a sell limit order in forex? These are orders to sell a currency pair at a higher price level. This allows you to exit a market at a better price than the current market price.

Forex sells limit order example: if the Eur/USD currency pair is 1.300, then you can set the sell limit at 1.400.

B. Forex Stop order

These are orders to sell or buy at a low price than the current market

Sell stop order

This order is put in place when you want to trade currency pairs at a lower price. Investors often believe that if a currency pair drops, it will trigger a bear run.

Forex sells stop order example: if the Eur/USD currency pair is 1.300, then you can set a sell stop order at 1.220.

Buy stop order

This order is put in place when you want to purchase a currency pair at a higher price.

Investors often believe that if a currency pair price increase, it will trigger a bull run.

For instance, if the Eur/USD currency pair is 1.300, then you can set a buy stop order at 1.350.

Other pending orders are stop loss and take profit orders. Forex buys limit buy stops are used to lock in profits in a favorable trade.

The forex live order book shows the most active forex orders in real-time, which can guide traders in making a trade.

Beginners should learn how to set pending orders in forex on the different Forex Platforms such as MT4 or have practice on the free demo account,

Setting forex Orders

There are no rules to follow on how to place the order in forex trading but generally should not be too close to the entry point or far away.

The position depends on the risk tolerance of an investor. The levels should provide room for prices to fluctuate a profitable direction while at the same protects against excessive losses.

Forex traders with long term positions apply Forex limit order strategy to minimize losses and to take profits.

Forex trading limit

Forex trading limits are fluctuations in prices allowed for currency pair during a trading session. The forex trading limit is necessary because it;

(1) help reduces market volatility

(2) protect investors against massive losses.

Stop level forex

This is a worse mistake that can befall n investor, which is a result of poor financial management and not understanding forex orders.

Stop level forex is a definite point whereby a forex broker automatically closes all active positions of a trader.

Conclusion

Thorough market orders explained and a firm understanding of the types of forex orders will enable you to use the correct order professionally to achieve your investment objectives, such as entering or getting out of a trade.

Be cautious in the volatile forex trade because the incorrect execution of orders can result in massive losses and psychological torture.