While occurring in trading as empty spaces between the opening and closing of a trade, a gap cannot be avoided in financial trading. Gaps are most common in stock trading but also occur less frequently in forex trading. Understanding the gap forex concept, significance, and gap trading strategy is essential for success in forex trading.

What is Gap Forex?

Gaps are acute interruptions in price without any trade taking place in between. They can either move up or down. In forex trading, forex gaps take place when there is no trade, particularly at the weekends and holidays. At such times forex trading is closed.

Furthermore, gaps happen within very short time frames like in a one minute chart or immediately after significant announcements. The significant announcements include economic data release and forex events with global impacts such as the coronavirus pandemic and discovery of drugs to fight the virus.

Technically, gap candle in forex is the difference between the closing price of a previous candlestick and the opening price of the next candlestick. After a bullish gap up or bearish gap down, prices often reverse to fill the market gap forex.

Gap meaning is a simple concept, and market gap forex occurs because the forex market is closed for weekends and holidays but remains active for international banks.

The Significance Of Gap Forex

Gap forex gives an indication of market sentiment towards a foreign exchange currency. Technically a gap down candlestick pattern indicates that no investors were willing to purchase at the price gap.

On the other hand, when the market exhibits a gap up candlestick pattern implies a lack of investors willing to sell at the price gap. Nevertheless, it is possible to gap beyond your stop order and get settled at a reduced price than the stop order.

At times forex gaps lead to corrective price action – after a gap, forex prices tend to reverse and fill up the gap. Following the forex gap fill, the price gap mostly changes directions to continue in the direction of the gap.

After all, the forex news that ignited the forex gap in the market is still active. The fading gap happens when the price gap is refilled within the same day.

Some forex traders generally stay away from the forex market when there is a forex gap. These traders fear forex gaps as it always leads to slippage, thus affecting the execution of stop and limit orders. Gap up down strategy can be risky and may result in losses.

But another crop of traders views forex gap trading simple and profitable. To them, a gap in the market presents golden opportunities to make money with a fixed stop-loss, a predictable take profit size, and a favourable pattern.

To make winning trades, traders have to consider gap levels, and gap filling in their gap up and gap down strategy. Gap up candlestick pattern shows areas of support, whereas the gap down candlestick pattern indicates the resistance level.

Types of Forex Gaps

Based on the time when the gap occurs, forex gap is divided into the weekly and intraday gap as outlined below:

Weekly Gap

it is a break in price between a trading week’s ending and the start of the next trading week. FX currency trading ends typically on Friday and resumes only on Sunday night. Over the weekend some fundamentals forex news may develop, causing a rapid change in the closing price of a currency pair.

In such situations, many buy/sell orders with no matching counter orders accumulate before forex trading resumes. As there are no buyers/sellers on the weekends, investors continue trading at actual prices different from the price gap. Weekly gaps are easily seen on the gap up chart pattern on most timeframes.

Intraday Gap

The gap in forex trading can also happen within a day, though rarely compared to the weekly forex gap. It usually occurs following a major economic report release or international news of extraordinary events.

After such events, forex investors change their forex sentiments and gravitate towards placing new orders at new prices that are higher or lower than the current forex market prices resulting in price breaks.

Classification of Price Gap Forex

Price gap forex is classified into four groups, namely:

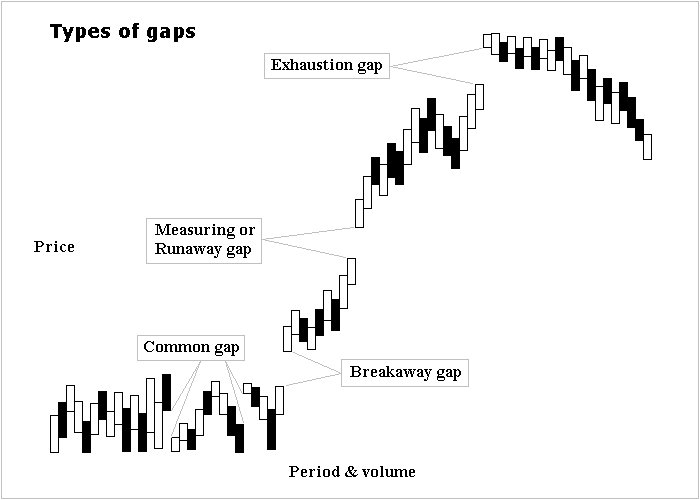

The breakaway gap: this occurs as a trend pattern ends and another one kicks in. Breakaways are not readily tradable.

Runaway gap: they typically occur in a price trend. The runaway gaps are safe and easy to trade as traders can easily predict its trend direction.

The exhaustion gap: exhaustion gaps occur at the end of a trend indicating final moments before price gap forex reversal.

The common gap: among the four groups of gaps, the common gap is widely traded and loved by many traders. while being safe to trade, they usually appear late Sunday or early Monday. They also occur after major holidays and important forex news.

What Are Gap Trading Strategies

Gap trading strategy in forex is based on weekly gap-filling, which means the price gap has resided to its original pre-gap level. Every Monday morning, after the forex market opens, there is always a price gap filling within the first hour of opening. Many traders love this strategy as it translates to over 70% in profitability.

When using gap trading strategy, there are essential factors to consider:

Assets: look for highly volatile forex pairs such as GBP/USD, EUR/USD, USD/JPY and USD/CHF.

Signal: price gap forex forms as trade resumes after a weekend or holiday.

Timeframe: consider 30 minutes *M30) at the start of a new trade.

In the event that a forex pair gaps up as trade resumes on Monday opening, it is advisable to sell – open a downward trade. Similarly, if the fx currency pair gap up during Friday close, then it’s time to buy.

The best time to enter a trade is 30 minutes after the market opens. Within the first 30 minutes, the market is adjusting towards a gap direction. As the initial candlestick closes M30 timeframe, enter into a new position in line with gap filling. Your target should be the week ending closing level.

However, the price gap may, at times go against you; thus initiate a stop-loss order to protect yourself. To determine a suitable stop loss level multiply take profit size by 1.5.

Moreover, do not forget to trade within your limits by using an acceptable risk per trade. To stay in forex trading for long using 1-2% of your trading capital is perfect. This move is essential because it is not always that the price gap gets filled in your favour, and you may incur losses.

Conclusion

Trading in the empty spaces between opening and closing trades is both risky and profitable as nothing is guaranteed in forex trading. Learning fundamentals and technical analysis basics are the foundation of gap trading strategy in forex.

Changes in fundamentals and technical lead to forex gaps. An effective way to test a gap up and gap down strategy is at the free demo account or paper trading.